African HealthTech: Discipline Over Aesthetics | The Founder's Blueprint for Sustainable Growth

For African HealthTech founders: Stop chasing vanity metrics. Learn the 3 pillars for sustainable growth—Cash Flow Before Clout, People Over Perfection, and Systems Over Speed—to build resilient, anti-fragile ventures.

Executive Summary: The Mandate for Resilience

The trajectory of success in the highly competitive and contextually complex African HealthTech sector is not determined by initial velocity or external image, but by operational rigor and internal resilience. Data analysis of startup failures consistently reveals that approximately 90% of long-term collapses stem from internal deficiencies—poor management, flawed leadership mindsets, or inadequate financial systems—rather than solely external obstacles like infrastructure or policy volatility.1 The pursuit of outward aesthetics, such as sophisticated branding, elaborate logos, or high-profile social media engagement—the “Clout Trap”—is a profound strategic miscalculation that distracts capital and focus from foundational systems. A business does not fail because its branding is imperfect; it fails because its operational finance is unsound.

This report establishes a foundational strategic blueprint for longevity, founded on three non-negotiable pillars of anti-fragile growth. First, Cash Flow Before Clout, mandating rigorous attention to unit economics and sustainable revenue generation. Second, People Over Perfection, prioritizing contextual trust, authentic service delivery, and competent, accountable leadership structures. Third, Systems Over Speed, requiring the proactive establishment of scalable operational architecture and robust regulatory compliance mechanisms. Successful African-led Deep Tech and HealthTech pioneers have validated that the path to longevity is characterized by prioritizing verifiable solvency and structural integrity, thereby positioning African innovation as a critical contributor to global health security.3

I. The Illusion of Arrival: Diagnosing the Clout Trap

1.1. Premature Scaling and the Vanity Metrics Epidemic

A significant strategic hazard for early-stage HealthTech enterprises is the preoccupation with the appearance of instantaneous success, referred to as the "Clout Trap." This phenomenon manifests as an obsession with external validation and the rapid creation of an image of a large, established corporation.1 This fixation often dictates decision-making concerning capital allocation and resource deployment. Specifically, founders are observed exhausting limited seed capital on non-essential expenditures, such as renting expensive offices in high-brow commercial areas or investing heavily in elaborate branding and marketing campaigns before a viable product is stabilized.1 This strategy prioritizes "branding before building" 1, dedicating resources to short-term image enhancement that yields zero long-term, verifiable value.

The financial cost of this ego-driven approach is steep, leading directly to financial strain and premature resource depletion. Furthermore, chasing rapid momentum without first establishing structural integrity—premature scaling—is highly detrimental. When a startup expands operations without the prerequisite systems, the underlying infrastructure rapidly collapses under the weight of increased demand. This internal vulnerability can cause a promising venture to implode immediately after securing a major client or achieving rapid, unstable expansion.1 The consequence is a business built on "vibes and social media Ads" that lacks the robust operational fundamentals necessary to manage increasing scale, customer retention, or cash flow demands.1

1.2. The African Failure Landscape: Internal Versus External Drivers

While the African operational environment undeniably presents unique external challenges—including unreliable power, poor logistics infrastructure, and policy instability—data reveals that these factors are often the trigger, not the root cause, of failure. The primary determinants of startup mortality are overwhelmingly internal strategic and operational deficiencies.1

Analysis consistently shows that the leading cause of failure is a fundamental lack of Product-Market Fit (P-M Fit), accounting for 42% of all collapses.7 This represents an internal failure of strategy—the founder built a solution for a non-existent or misidentified problem, often resulting from building in isolation or overestimating market readiness.1 The second most common cause of failure is directly tied to financial collapse, with 38% of startups failing due to a lack of cash flow 7, and 16% due specifically to financial issues.8 The combination of strategic misalignment (P-M Fit) and financial execution failures (Cash Flow) accounts for the vast majority—approximately 80%—of startup deaths.

The critical relationship between external friction and internal weakness must be fully appreciated. The African operating environment imposes what can be described as the "Infrastructure Tax Amplification Loop." Startups perpetually face high external friction (e.g., erratic supply chains, fragmented regulation). When a startup is internally fragile—characterized by poor management, limited cash reserves, or non-existent operational systems 1—this friction acts as a multiplier. A sudden, predictable external shock, such as a major currency devaluation or a regulatory reversal, which a well-capitalized and structured system could absorb, instantly proves catastrophic for a vulnerable venture. Consequently, the failure is fundamentally one of internal vulnerability to foreseeable external shocks, underscoring that poor management and flawed financial planning are the primary execution failures.1

The table below contrasts the detrimental strategies of image-chasing with the necessary discipline required for structural endurance.

Aesthetics vs. Discipline: The Foundational Trade-Off

|

Focus Area |

The Clout Trap (Rushing to Look Successful) |

The Discipline Path (Learning to Stay Sustainable) |

Outcome Differential |

|

Capital Allocation |

Renting expensive offices, high spending on non-essential branding/suits.1 |

Maximizing runway, investing only in core, compliance-critical systems (e.g., cold chain, inventory tech). |

Premature Exhaustion vs. Operational Longevity (38% failure due to cash flow 7). |

|

P-M Fit Validation |

Confusing peer/social media validation with actual traction.1 |

Serving well, rigorous user-centric design, and relying exclusively on feedback from paying customers.7 |

42% P-M Fit failure vs. Resilient Market Acceptance. |

|

Team Structure |

Founder clinging to excessive control/titles, hiring based on personal relationships.1 |

Hiring specialized CEOs/operators, establishing defined processes, and implementing strict accountability metrics. |

Collapse under scale vs. Systemic Growth. |

II. Pillar 1: Cash Flow Before Clout—The Arithmetic of Survival

2.1. The Criticality of Unit Economics in Fragmented Markets

The financial foundation of a sustainable HealthTech enterprise lies in rigorous unit economics. A common and potentially fatal assumption made by founders is that achieving volume or scale will inevitably lead to economies of scale and improved margins. In Africa's fragmented, high-friction operational landscapes, the opposite is often true: scaling frequently amplifies problems.9 Increased volume necessitates dealing with greater logistics complexity, higher customer acquisition costs (CAC) due to market segmentation, and escalating infrastructure expenses (e.g., generators, reliable internet).9

To counter this reality, financial modeling must incorporate the Structural Scaling Penalty (SSP). This dictates that the non-traditional costs of doing business—such as power instability, poor road networks, logistical bottlenecks, and customs friction—must be explicitly costed into the Cost of Goods Sold (COGS). A failure to do so results in a positive topline revenue figure that masks a negative contribution margin (CM). The imperative is clear: the startup must achieve a positive CM per transaction before seeking external investment for major scaling. If the fundamental math does not yield a profit at the unit level, increasing transaction volume merely accelerates the rate of cash burn and exacerbates the funding shortage that results in failure.6

2.2. Sustainable Revenue Models in HealthTech

Achieving financial independence requires a strategic departure from models that rely indefinitely on grant funding or philanthropic support.10 While grants can provide crucial early-stage research and development capital, the objective must be to build commercially viable businesses.

African health social enterprises provide a structural model for balancing purpose with profit. Half of the 267 identified health care social enterprises in Africa operate as for-profit organizations, utilizing market-based approaches to deliver essential products and services to low-income communities.11 This necessitates the design of hybrid business models that explicitly reconcile the social mission with robust commercial objectives.4 For Deep Tech solutions—those rooted in fundamental scientific innovation, such as Artificial Intelligence or advanced biotechnology 3—the commercial pathway often involves protecting intellectual property (IP) and securing patents to create defensible market positions. SensThings in Morocco, for instance, successfully commercialized a patented "phygital" security technology, demonstrating the viability of translating advanced science into commercial assets.3

Effective scaling requires careful consideration of billing models, pricing strategies, and mechanisms for reimbursement in diverse Sub-Saharan African healthcare landscapes.12 Strategic ventures often combine revenue streams; for example, mPharma, a Ghanaian pharmaceutical access startup, secured funding from impact investors and international financial institutions (like the International Finance Corporation) alongside revenue earned from operations, demonstrating resilience against volatile venture capital markets.13

2.3. Operationalizing Financial Honesty

The discipline required for survival mandates rigorous financial honesty, confronting poor budgeting, cost control, and the pervasive misallocation of resources identified as common pitfalls.6 This financial discipline informs the critical ability to make strategic, sometimes counterintuitive, decisions.

Operational wisdom dictates that "growth" is not a linear obligation. Instead, sustainable growth sometimes requires "saying no, downsizing, or pausing until you fix the leaks" [Manifesto]. This requires the courage to halt unstable or cash-negative expansion and conserve capital when unit economics are unfavorable or systems are failing.1 This period of strategic constraint—a pause for operational optimization—is vital.

Furthermore, mitigating the significant risk associated with fragmented local funding requires adopting a Dual-Market Risk Mitigation Strategy. Innovations designed to be cost-effective and high-impact for African contexts inherently possess global relevance. A strategic focus on achieving international standards and approvals (like Neopenda's neonatal monitor obtaining FDA approval) allows founders to leverage strong secondary markets in the United States and Europe.10 This secondary market potential provides necessary financial diversification and early capital, which is essential for surviving the protracted local regulatory and funding cycles common for med-tech solutions in Africa.2 This approach transforms the necessity of lean African design into a globally marketable asset, securing the financial runway necessary for local scaling.

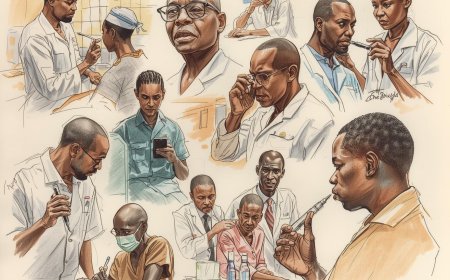

III. Pillar 2: People Over Perfection—The Trust Engine of Service

3.1. Achieving Contextual Product-Market-Trust Fit (P-M-T Fit)

The 42% failure rate attributed to a lack of Product-Market Fit necessitates that founders abandon the practice of "building in isolation" and instead prioritize authentic market adaptation.1 In the high-stakes sector of healthcare, P-M Fit must be upgraded to Product-Market-Trust Fit (P-M-T Fit).

Solutions must be locally creative, home-grown, and both culturally and technologically adapted to specific local conditions.14 Technologies that are imported or designed without deep appreciation for the community configuration or cultural values are often rejected by the target populations.14 Therefore, a mandatory step in the innovation lifecycle is co-creation with local communities and adherence to user-centric design principles.4

The ultimate anti-clout mechanism is superior service quality. The manifesto accurately states that "Customers remember experience, not aesthetics." In contexts where institutional medical mistrust is prevalent 15, an impeccable, culturally responsive service experience directly builds the necessary P-M-T Fit. This organic trust acts as effective, low-cost marketing, thereby mitigating the financial drain associated with the high Customer Acquisition Costs (CAC) required by aesthetic-driven, trust-deficient strategies.

3.2. Building Patient and Provider Trust (The Healthcare Crucible)

Trust is not a peripheral concern in healthcare; it is a "salient construct" that fundamentally dictates care-seeking behaviors and service utilization.16 In post-crisis or resource-constrained settings, a lack of trust acts as a major barrier to the adoption of services.16

Startups must recognize that mistrust often stems from institutional policies or perceived motives, such as the concern that healthcare organizations are more concerned about profitability than patient care.15 Building trust requires transparency and a clear examination of how the institution operates to avoid reinforcing this perception.

When implementing advanced technologies, such as Artificial Intelligence, the regulatory framework must integrate local cultural values and proactively address biases to foster public acceptance.17 For example, cultural worldviews, sometimes informed by religious beliefs, may emphasize communal values and trust in human caregivers. Ethical AI development must therefore integrate culturally sensitive understanding to align technology with the needs of diverse and resource-constrained populations.17 Lessons from post-Ebola Guinea demonstrate the actionable necessity of this approach: global health programs were forced to employ qualitative research to define the specific, client-defined domains of trust that were barriers to care, and then developed interventions to address those domains directly.16

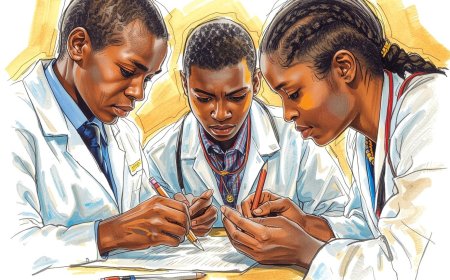

3.3. Internal People Systems: The Leadership Mindset Shift

Internal discipline extends beyond financial management to encompass leadership structure. A crucial challenge for many founders involves distinguishing between the roles of the Founder and the CEO.1 The Founder is an act of creation, driven by passion and vision. The CEO, however, requires specialized operational skills—organizational leadership, financial literacy, strategic planning, and people management.1 Many high-potential startups fail because the founder stubbornly clings to the CEO title despite lacking the operational competence required to manage a business at scale, often exacerbated by the refusal to step back or hire a more capable operator.1

This systemic flaw is often compounded by the "Oga at the Top" syndrome, where ego drives control issues. Founders struggle to delegate, refuse constructive feedback, and hire personnel based on personal relationships rather than documented competence.1 This destroys accountability and prevents the establishment of a robust, system-driven team structure. Longevity requires establishing clear performance expectations, defined growth paths, and fair compensation to transition the organization from reliance on the founder's charisma to reliance on institutional structure and managerial excellence.1

IV. Pillar 3: Systems Over Speed—The Infrastructure of Longevity

4.1. Engineering for Anti-Fragility: Building Operational Systems

The foundational error of premature scaling is the failure to recognize that growth is a function of structure, not simply momentum. Scaling requires proactively building systems, processes, and teams capable of handling significant expansion without internal collapse.1 Startups must transition from operations built on subjective enthusiasm ("vibes") to those supported by robust operational fundamentals.1 This includes establishing standardized systems for tracking cash flow, efficiently managing customer complaints, enhancing retention, and maintaining efficient workflows.1

For Deep Tech solutions, structural planning also encompasses addressing specific risks related to advanced innovation. This includes implementing mechanisms for protecting Intellectual Property (IP), fostering technology transfer from academia, and mitigating the inevitable talent gaps caused by brain drain—a crucial step for ensuring long-term workforce sustainability.3

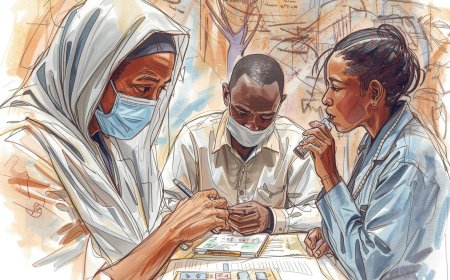

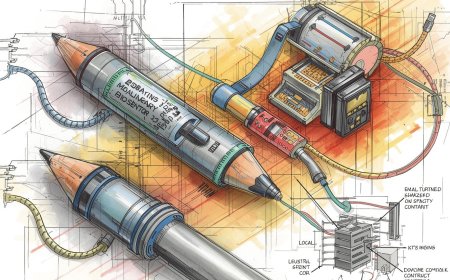

4.2. Regulatory Compliance as a Strategic Moat

Regulatory engagement must be viewed not as a compliance burden, but as a critical strategic component and a source of competitive advantage. Founders who proactively embed regulation into the design of their product and business model tend to scale faster and with less disruption.18 Transparent and early communication with regulatory bodies—participating in policy discussions and regulatory sandboxes—builds credibility that external competitors cannot easily replicate.18

For HealthTech companies dealing with physical products, such as diagnostics or pharmaceuticals, Good Storage and Distribution Practices (GSDP) compliance is a strategic imperative.19 GSDP provides the quality assurance system necessary to combat the proliferation of substandard and falsified medical products (SFMPs).19 The integrity of medical products depends just as much on their storage and distribution as their manufacturing, necessitating rigorous practices like cold chain management for Time and Temperature Sensitive Pharmaceutical Products (TTSPPs).19 Specialized training programs, such as the CMCOMMS Medical Logistics Practitioner Training Programme, which includes modules on GSDP compliance and regulatory audit readiness, are crucial for building a competent, recognized, and sustainable workforce capable of safeguarding product quality across challenging logistical terrains.19

Furthermore, for digital health innovations, cybersecurity functions as a "trust engine".18 Robust data protection policies and incident response readiness are prerequisites for attracting institutional funding, as they signal governance maturity and the ability to safeguard sensitive customer data, which is essential for user confidence and regulatory credibility.18

Verifiable compliance, specifically in areas like GSDP and cold chain integrity, serves as a crucial mechanism for de-risking supply chain investment for international partners. When a startup invests early and demonstrably in quality assurance, achieving accredited standards and audit readiness (as recognized by bodies like the Medicines Control Authority of Zimbabwe, MCAZ 19), it establishes a high-quality baseline. This professionalization mitigates the risk for multinational corporations (MNCs) and procurement entities interested in corporate venture capital or technology transfer partnerships 10, effectively transforming a regulatory requirement into a system-enabled mechanism for attracting capital.

4.3. Strategic Collaboration for Scaling

Longevity in the African HealthTech market is rarely achieved through solo effort. Multi-stakeholder collaboration is non-negotiable, particularly in managing the complexities of supply chain integrity (which involves logistics companies, humanitarian agencies, and community organizations).19

The most successful scaling models involve leveraging existing infrastructure and local expertise through strategic partnerships, joint ventures (JVs), or corporate VC investments.10 These alliances allow startups to mitigate local risks and expedite market penetration.

-

LifeBank (Nigeria): This blood delivery startup demonstrated strategic acuity by collaborating directly with state governments and the Nigerian Institute of Medical Research, leveraging institutional infrastructure to expand its vital services.13

-

Flare (Kenya): The company revolutionized emergency healthcare access by creating a "911" system, partnering specifically with existing local ambulance services and hospitals to improve response times by utilizing established physical assets.13

-

Chefaa (Egypt): This pharmacy delivery platform maximized its logistical reach by forming direct partnerships with pharmaceutical companies and local pharmacies to ensure reliable and timely medication delivery.13

These case studies underscore that speed is best achieved by integrating structure, not by outrunning it.

V. The Discipline of the Long Game: Strategic Resilience

5.1. Strategic Pauses and Downsizing: Growth Through Constraint

The disciplined founder chases readiness before momentum. Full-scale implementation should only proceed after thoroughly testing the necessary infrastructure—including data systems, supply chain logistics, and the human capacity required to support the methodology.5 The discipline of the long game necessitates the courage to pivot or downsize. Founders often become unduly attached to their initial brilliant concept, but market realities demand adaptability.1

Strategic contraction, pausing operations, or downsizing must be reframed not as failure, but as a necessary, disciplined action to "fix the leaks" that compromise financial viability or systemic integrity [Manifesto]. This constraint ensures capital is conserved and focused on stabilizing the core operational model before aggressive expansion is considered, preventing the implosion that accompanies unstable, premature growth.

5.2. Conclusion: Showing Up, Not Showing Off

The evidence overwhelmingly supports the founding principle that long-term viability in the African HealthTech sector is a consequence of discipline, not aesthetics. The most resilient ventures focus their limited capital and attention on the verifiable internal determinants of success: positive unit economics, structural systems for quality assurance (GSDP, cold chain), and authentic trust built through impeccable service and accountable leadership.

The true competitive metrics for the African HealthTech founder are not superficial social media engagement or inflated valuation, but rather operational integrity and survival capacity. Success is found in the rigorous pursuit of:

-

Financial Rigor: Ensuring the math works at the unit level, incorporating the Structural Scaling Penalty, and achieving positive Contribution Margin before scale.

-

Trust Cultivation: Achieving P-M-T Fit by embracing co-creation and cultural adaptation, making service quality the primary marketing engine.

-

Systemic Integrity: Treating compliance (especially GSDP and cold chain) as a strategic asset that de-risks the business for partners and ensures product quality.19

In the long run, the sustained, often unglamorous effort of "showing up"—focusing on internal rigor—will always outlast the superficial ambition of "showing off."

The Resilience Checklist: Operationalizing Discipline

|

Pillar |

Clout (Aesthetic) Metric (To Be Avoided) |

Discipline (Sustainability) Metric (To Be Prioritized) |

Supporting Evidence |

|

Cash Flow |

Total Funding Raised; Vanity Valuation; Social Media Likes. |

LTV/CAC Ratio; Gross Margin % post-logistics; Runway in Months. |

38% fail due to cash flow; scale often increases cost in Africa.7 |

|

People |

Positive press reviews; Peer validation from other founders.1 |

Customer Retention Rate (CRR); Patient Service Utilization % (P-M-T Fit); Successful Founder-to-CEO transition.1 |

Trust is vital determinant for care-seeking; experience, not aesthetics, drives retention.16 |

|

Systems |

Speed of Launch/Momentum; Number of new markets entered quickly. |

GSDP Compliance Score; Systemic Bottleneck Resolution Rate; Regulatory Audit Readiness Status.5 |

Structure is prerequisite for stable scale; GSDP safeguards product integrity.19 |

Works cited

-

Beyond infrastructure and policy, this is why Nigerian startups fail ..., accessed October 23, 2025, https://www.thecable.ng/beyond-infrastructure-and-policy-this-is-why-nigerian-startups-fail/

-

What is coming next in health technology startups? Some insights and practice guidelines, accessed October 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10668566/

-

The African Deep Tech & HealthTech Frontier: Strategies for Founder-Led B2B SaaS Innovation - Magazine, accessed October 23, 2025, https://magazine.doctorsexplain.net/the-african-deep-tech-healthtech-frontier-strategies-founder-led-b2b-saas-innovation

-

Translating Medical and Healthcare Research into Profitable ..., accessed October 23, 2025, https://magazine.doctorsexplain.net/medical-healthcare-research-translation-africa

-

A framework for scaling up health interventions: lessons from large-scale improvement initiatives in Africa - PubMed Central, accessed October 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4731989/

-

10 Reasons Why African Startups Fail - Tech In Africa, accessed October 23, 2025, https://www.techinafrica.com/10-reasons-why-african-startups-fail/

-

The Short Life Expectancy of African Startups – Why African Startups Die Young, accessed October 23, 2025, https://au-startups.com/2024/02/09/the-short-life-expectancy-of-african-startups-why-african-startups-die-young/

-

Startup Failure Rate Statistics (2025) - Exploding Topics, accessed October 23, 2025, https://explodingtopics.com/blog/startup-failure-stats

-

Failed Nigerian Startups: Lessons, Mistakes & What to Avoid - PlanetWeb Solutions, accessed October 23, 2025, https://planetweb.ng/failed-nigerian-startups/

-

Medtech and Healthtech in Africa: Opportunities and Investment - LSI USA, accessed October 23, 2025, https://www.lsiusasummit.com/news/medtech-and-healthtech-in-africa-opportunities-and-investment

-

Several Models for Sustainable Partnerships and Private-Sector Engagement - NCBI, accessed October 23, 2025, https://www.ncbi.nlm.nih.gov/books/NBK540853/

-

The Business Side of Digital Health: Billing, Pricing, and Reimbursement in Sub-Saharan Africa - Magazine, accessed October 23, 2025, https://magazine.doctorsexplain.net/the-business-side-of-digital-health-billing-pricing-and-reimbursement-in-sub-saharan-africa

-

Africa's Medtech Revolution. Navigating Challenges: The Resilience… - Tomi Davies (TD), accessed October 23, 2025, https://tomidee.medium.com/africas-medtech-revolution-11f3dfc4bc49

-

Conceptualization and practices in digital health: voices from Africa - PMC - PubMed Central, accessed October 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9382467/

-

Understanding and Ameliorating Medical Mistrust Among Black Americans, accessed October 23, 2025, https://www.commonwealthfund.org/publications/newsletter-article/2021/jan/medical-mistrust-among-black-americans

-

The Salience of Trust to the Client-Provider Relationship in Post-Ebola Guinea: Findings From a Qualitative Study - PMC - PubMed Central, accessed October 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8885337/

-

Public trust of AI in healthcare in South Africa: results of a survey - PMC - PubMed Central, accessed October 23, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12379453/

-

Don't Chase Growth — Chase Readiness: Ifeyinwa Okoli on building resilient startups in Africa's fintech future – Business A.M - Businessamlive, accessed October 23, 2025, https://businessamlive.com/dont-chase-growth-chase-readiness-ifeyinwa-okoli-on-building-resilient-startups-in-africas-fintech-future/

-

Raising the bar for Africa's health supply chains - Leadership, accessed October 23, 2025, https://www.leadershiponline.co.za/raising-the-bar-for-africas-health-supply-chains/

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0