How to Commercialize a Point-of-Care Diagnostic in Africa: Regulatory Path and Partners

A practical, Africa-tailored, SEO-optimized playbook for commercializing point-of-care (POC) diagnostics: from QMS and WHO prequalification to national registration, procurement partners, local manufacturing and go-to-market tactics. Includes regulatory checkpoints for Kenya, Nigeria and South Africa, real partner organizations, a step-by-step roadmap, and rib-cracking clinic anecdotes so the reading nurse on night-shift won’t fall asleep. APA citations and live links included.

Brief: This article guides entrepreneurs, startup founders, product managers and health-programme leads on the pragmatic path to bring a point-of-care (POC) diagnostic to market in Africa. Expect clear regulatory steps (global → regional → national), a list of practical partners, quality and procurement musts, and two real-looking case vignettes that will make your CFO smile (or cry — but productively).

Why build and commercialize POC diagnostics in Africa? (Short, blunt, optimistic)

POC diagnostics (rapid tests, cartridge-based molecular assays, near-patient analyzers) reduce time-to-treatment, keep pregnant mothers and febrile children out of long queues, and cut downstream costs for hospitals. Donors and procurement agencies frequently require WHO prequalification or recognized regulatory approval for large tenders; without these, scale is hard. If you want to sell at scale — especially into public procurement and international agencies (UNICEF, Global Fund) — you must design for quality and regulatory acceptance from day one. WHO Extranet+1

Fast, funny, and sadly true anecdote (read in the voice of your most dramatic lab tech)

“Meet Amina. She built a malaria rapid test in her garage that detects malaria faster than her father’s morning oath-filled ‘I’ll fix the internet’ vow. She sold her first 50 tests to the clinic two streets away — until the district tender required WHO prequalification and a DPA. Suddenly, Amina realised making a test is like making a baby: the delivery is only the start; the paperwork keeps the thing alive.” — practical lesson: regulatory + procurement readiness = survival.

The 9-step high-level commercialization checklist (copy this, paste on the wall)

-

Define intended use & target markets (which countries, health system level, disease burden).

-

Implement a Quality Management System (ISO 13485) and risk management (ISO 14971). ISO+1

-

Generate performance data (analytical validation, clinical accuracy studies in intended population).

-

Decide regulatory route: WHO Prequalification (PQ) / EUL, regional reliance pathways (e.g., AMA in future), or national registration (SAHPRA, NAFDAC, Pharmacy & Poisons Board Kenya). WHO Extranet+2SAHPRA+2

-

Prepare the dossier (technical file, risk assessment, labeling, IFU in local languages).

-

Secure manufacturing & supply-chain partners (local assembler or contract manufacturer; evaluate GMP / ISO 13485). PATH

-

Engage procurement/impact partners early (FIND, PATH, UNICEF, Global Fund, national programmes). finddx.org+2PATH+2

-

Pilot implementation + post-market surveillance plan (training, usability, adverse event reporting).

-

Market access & pricing strategy (tenders, private market, NGO partners, bundled service models).

Regulatory pathways explained — global → continental → national

1) Global (WHO EUL → WHO Prequalification of IVDs)

If your aim is donor procurement (UNICEF, Global Fund) or broad UN-agency tenders, WHO listing matters. Two WHO routes are common:

-

Emergency Use Listing (EUL): risk-based, quicker (used in emergencies). Useful for rapid access but usually transitional. World Health Organization+1

-

WHO Prequalification (PQ) for IVDs: the gold standard for procurement by many UN agencies; includes performance, manufacturing site audits and dossier review. Getting PQ increases eligibility for large tenders. See WHO’s public list of prequalified IVDs. WHO Extranet+1

Practical note: EUL can help you win early emergency procurement; PQ is necessary for sustainable scale.

2) Continental/regional — African Medicines Agency (AMA) & harmonisation

The African Union has created the African Medicines Agency (AMA) to harmonize regulatory approaches across member states. AMA aims to speed cross-border approvals and build regulatory capacity — but national agencies still govern market entry today. Track AMA developments and opportunities for reliance pathways. African Union+1

3) National regulators — examples

You will almost always need national registration to sell in a country. Three common markets with active, public guidance:

-

Kenya — Pharmacy and Poisons Board (PPB): publishes guidelines for registration of medical devices including IVDs; requires dossier, classification and reregistration notices. web.pharmacyboardkenya.org+1

-

Nigeria — NAFDAC (and VBM/RR guidance): NAFDAC provides specific guidelines for medical devices and IVD registration and reliance procedures; recent updates (2024–2025) clarify dossier and screening steps. NAFDAC+1

-

South Africa — SAHPRA: detailed device and IVD classification/registration guidelines with templates and timelines. South Africa is often used as a regulatory beachhead in southern Africa. SAHPRA+1

Action item: Read the national guideline PDF before you draft study protocols — regulators often require country-specific clinical data and labeling.

Quality systems & standards you can’t skip

-

ISO 13485 (QMS) — expected by most stringent regulators and purchasers; implement early. ISO

-

ISO 14971 (risk management) — required for device safety arguments.

-

Good Manufacturing Practices (GMP) and supplier audits — necessary for contract manufacturers.

-

WHO PQ audit / site inspection — WHO will inspect manufacturing sites during PQ assessment. WHO Extranet

Getting these systems right early reduces expensive rework after failed audits.

Data & clinical evidence: how much is “enough”?

Regulatory expectations vary:

-

Analytical validation (LOD, specificity, sensitivity).

-

Clinical performance in intended populations (field accuracy studies).

-

Usability and human factors studies for POC use by non-lab staff.

Donor agencies may require independent evaluations or WHO-style public reports. Plan clinical studies in the countries where you intend to sell — regulators sometimes want local data (e.g., malaria RDTs may require studies in areas where malaria is endemic). WHO Extranet

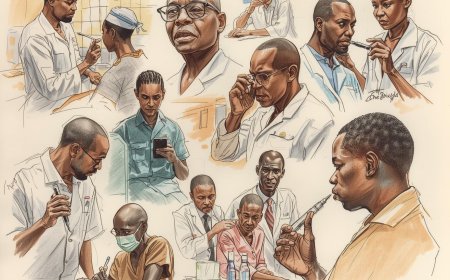

Key partners across the commercialization journey (who to call, and when)

Technical & validation partners

-

FIND (Foundation for Innovative New Diagnostics): diagnostics evaluations, test performance, and market entry support. FIND runs independent evaluations and can help with product validation and procurement introductions. finddx.org+1

-

PATH: tools, protocols and commercialization support for diagnostics and local manufacturing linkages. PATH+1

Procurement & funding partners

-

UNICEF Supply Division: large buyer for diagnostics (technical procurement requirements including IVD technical specs). Having UNICEF technical compliance opens big markets. UNICEF+1

-

Global Fund / PEPFAR / Unitaid / World Bank: fund large tenders for disease-specific programs; often require WHO PQ or recognized approvals.

-

Philanthropic funders (e.g., Gates Foundation): can fund scale-up, manufacturing or tech transfer in Africa. Examples of Gates investments in local manufacturing show funding interest in local production capacity. AP News

Manufacturing & local production partners

-

Local African manufacturers & CMOs: PATH and other groups keep databases of manufacturers in Africa to facilitate localized production and tech-transfer. Local assembly reduces shipping costs and may ease data-residency concerns. PATH

Market & implementation partners

-

National disease programmes (malaria, TB, HIV) — early engagement helps align product use and procurement.

-

Distributors with experience in medical tenders — local distributors know procurement cycles and warehousing logistics.

Procurement reality: how governments and agencies buy diagnostics

Major buyers (UNICEF, Global Fund, country ministries) use tender processes that typically require:

-

Product dossier (technical file).

-

Proof of regulatory clearance (WHO PQ, national registration, CE marking or FDA may sometimes be considered).

-

Manufacturing capacity and quality certificates (ISO 13485).

-

Competitive pricing and supply guarantees.

UNICEF and other buyers publish technical requirements and supplier onboarding documents — study them before tendering. UNICEF+1

Two practical case vignettes (realistic, anonymised)

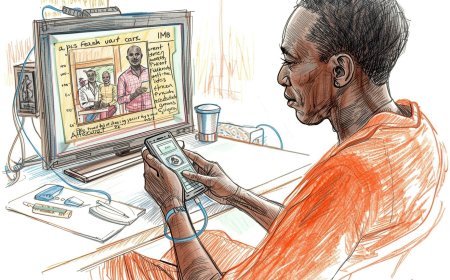

Case A — Okoth Diagnostics, Nairobi (hypothetical)

Okoth builds a low-cost rapid test for Group B Streptococcus to improve newborn care. They:

-

Implemented ISO 13485 with a local consultant. ISO

-

Ran analytical and a small clinical accuracy study at two Kenyan hospitals.

-

Applied to the Pharmacy and Poisons Board with a dossier; simultaneously engaged FIND for independent evaluation. web.pharmacyboardkenya.org+1

-

After national registration, Okoth began pilot procurement with a county health department and used PATH’s implementation protocols to train nurses. PATH

Outcome: By sequencing QMS → evidence → national registration → pilot procurement, Okoth avoided a common trap: building a product no one could legally buy at scale.

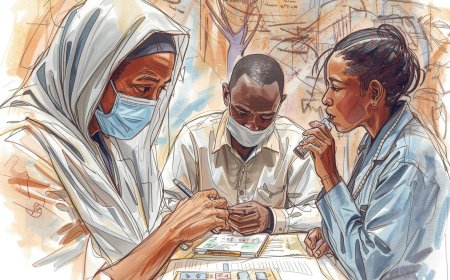

Case B — Lagos Molecular Start-up, Lagos (hypothetical)

A Lagos firm develops a cartridge molecular assay for TB:

-

They sought WHO PQ after promising local data, but used a staged approach: first secure SAHPRA registration and local hospital contracts, then pursue WHO PQ and regional tenders. They partnered with a South African contract manufacturer to meet ISO 13485 and WHO audit requirements. SAHPRA+1

Lesson: Where WHO PQ is lengthy, use national registration + local procurement to build revenues while scaling quality systems for PQ.

Practical dossier checklist (what regulators & procurers will ask)

-

Device description, intended use and classification.

-

Design & manufacturing information (processes, BOM).

-

Quality Management System certificates (ISO 13485). ISO

-

Analytical performance (LOD, cross-reactivity, precision).

-

Clinical performance studies (protocols, results, statistical analysis).

-

Labeling, IFU in English and relevant local languages.

-

Stability data (shelf life under tropical conditions).

-

Post-market surveillance plan & complaint handling.

-

Packaging, transport and storage conditions (cold chain if required).

-

Manufacturing site information and audit reports.

Pricing & market access tips

-

Model three price tiers: private clinic retail, government tender price, donor procurement price.

-

Factor in import duties, taxes, distributor margins and local warehousing.

-

Consider “test + service bundle” models (device + consumables + training) — often attractive to ministries.

Post-market surveillance & vigilance — don’t ignore this

Regulators increasingly require adverse event reporting and field performance monitoring. Create simple reporting channels (SMS hotline, email, online form) and commit to corrective actions. SAHPRA, NAFDAC and PPB all publish adverse event reporting requirements. SAHPRA+2NAFDAC+2

Step-by-step commercialization roadmap (detailed)

Phase 0 — Concept & feasibility

-

Define intended use & target countries.

-

Market research: disease burden, existing tests, buyer requirements.

Phase 1 — Design & QMS

-

Implement ISO 13485 compliant QMS. ISO

-

Build design controls and risk management (ISO 14971).

Phase 2 — Validation & clinical evaluation

-

Analytical validation in lab.

-

Clinical accuracy study at intended sites (pre-agreed with regulators).

Phase 3 — Regulatory submissions & local pilots

-

Prepare and submit national dossier(s). web.pharmacyboardkenya.org+2NAFDAC+2

-

Run implementation pilots with district health partners and NGOs.

Phase 4 — Scale: PQ & procurement

-

Apply for WHO PQ (or EUL if emergency) while scaling manufacturing and supply. WHO Extranet+1

-

Begin tendering for national programs and engage UNICEF/Global Fund windows.

Phase 5 — Sustain

-

Post-market surveillance, product iterations, local production scale-up, pricing adjustments.

Common traps — and how to avoid them (do this)

-

Trap: Treating regulatory approval as an end. Fix: Plan post-market and procurement simultaneously.

-

Trap: Skipping ISO 13485 to save cash. Fix: It’s an investment — without it large buyers will ignore you. ISO

-

Trap: Relying solely on a single country approval. Fix: Build a parallel plan for WHO PQ or regional reliance to access donors.

Useful links & where to read the rules (live, APA-style)

Below are the main regulatory & partner resources mentioned in this article. These are the “must-read” links for dossier writers and business leads.

-

World Health Organization. (n.d.). WHO Prequalification of In Vitro Diagnostic Products — List of prequalified IVDs. https://extranet.who.int/prequal/vitro-diagnostics/prequalified/in-vitro-diagnostics. WHO Extranet

-

World Health Organization. (n.d.). Emergency Use Listing Procedure (EUL). https://www.who.int/teams/regulation-prequalification/eul. World Health Organization

-

Pharmacy and Poisons Board (Kenya). (2022). Guidelines for Registration of Medical Devices Including In-Vitro Diagnostics. https://web.pharmacyboardkenya.org/download/guidelines-for-registration-of-medical-devices-including-in-vitro-diagnostics/. web.pharmacyboardkenya.org

-

National Agency for Food and Drug Administration and Control (NAFDAC) (Nigeria). (2025). Guidelines for Registration of Medical Devices Including In-Vitro Diagnostics (IVDs) (PDF). https://nafdac.gov.ng/wp-content/uploads/Files/Resources/Guidelines/VBM_R%26R/2025-2030/Guidelines-for-Registration-of-Medical-Devices-Including-In-Vitro-Diagnostics-IVDs-and-Related-Products.pdf. NAFDAC

-

South African Health Products Regulatory Authority (SAHPRA). (2025). Medical Devices and In-Vitro Diagnostics Guidelines. https://www.sahpra.org.za/medical-devices-and-in-vitro-diagnostics-guidelines/. SAHPRA

-

FIND. (n.d.). FIND — Diagnosis for all. https://www.finddx.org/. finddx.org

-

PATH. (n.d.). Diagnostics — PATH. https://www.path.org/who-we-are/programs/diagnostics/. PATH

-

UNICEF Supply Division. (n.d.). Diagnostics. https://www.unicef.org/supply/diagnostics. UNICEF

-

PATH. (n.d.). Diagnostic manufacturer resources (Africa). https://www.path.org/who-we-are/programs/diagnostics/diagnostic-manufacturer-in-low-and-middle-income-countries/. PATH

-

ISO. (n.d.). ISO 13485:2016 — Medical devices — Quality management systems. https://www.iso.org/standard/59752.html. ISO

-

WHO Prequalification of IVDs. (2024). List of prequalified in vitro diagnostic products (PDF). https://extranet.who.int/prequal/sites/default/files/document_files/list-of-prequalified-in-vitro-diagnostic-products_3.pdf. WHO Extranet

-

Bill & Melinda Gates Foundation coverage (example of donor interest in local manufacturing). (2023). Gates Foundation funding of local vaccine manufacturing projects. https://apnews.com/article/fa28c0502925a4152df1709cc8f228fe. AP News

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0