Manufacturing Rapid Diagnostic Tests Locally: Pros & Cons — A Kenya Case Study

A practical, Africa-focused guide on the tradeoffs of producing rapid diagnostic tests (RDTs) locally vs importing them. Uses Kenya as a case study (industry wins, regulatory path, QA needs, supply-chain and market realities), lays out operational checklists and a 12–18 month roadmap for a local manufacturer, and includes pragmatic cost, procurement and scale advice — with real-world citations and links.

Short brief: Local RDT manufacturing can flip the script on test access, supply security and jobs — but it’s not a free lunch. Expect high capital costs, steep quality requirements, and tangled procurement paths. This article helps hospital procurement teams, medtech founders, policymakers and donors decide whether and how to bring rapid-test production home — with a pragmatic checklist and a Kenya-flavoured roadmap.

Opening anecdote (because someone once had to learn the hard way)

When a county lab manager in Mombasa got a shipment of cheap imported RDTs, he noticed half the boxes lacked expiry dates in English. Staff stopped using them. That shortage led a local entrepreneur — who could read regulatory forms in English and Kiswahili — to build a factory in Kilifi. Six months later the clinic had reliable supplies and the entrepreneur had convinced a big donor to test-purchase 200,000 kits. That pivot — from broken supply to local production — is why this topic matters. Health Business+1

The big picture — why local manufacturing is back on the agenda

Africa imports the vast majority of finished diagnostics and medical products. WHO and regional partners are pushing local production to strengthen health security, shorten lead times and keep dollars in domestic economies. In recent years donors and technical partners (FIND, Unitaid, WHO) have actively supported tech transfer and regional manufacturing initiatives for COVID and other priority tests. At the same time, private players have started facilities in Africa — Kenya now hosts a high-capacity RDT facility with continent-scale aspirations. WHO | Regional Office for Africa+2finddx.org+2

Pros of producing RDTs in-country (what excites people)

-

Supply-chain resilience & shorter lead times — local factories avoid long ocean freight delays, export restrictions and volatile FX shocks. Countries can respond faster during outbreaks. WHO | Regional Office for Africa

-

Jobs, skills and industrial policy — manufacturing builds jobs, develops technical skills (QA, packaging, sterile assembly) and aligns with national industrialization plans. Kenya’s manufacturing announcements highlight local employment and export ambitions. Health Business+1

-

Lower landed cost for some products (over time) — after amortizing capital and if inputs can be sourced regionally or imported at low duty, total landed cost can be competitive — especially when freight and tariffs on finished products are high. industrialization.go.ke

-

Easier compliance with local regulatory / language needs — locally produced labels, local-language IFUs, and faster interactions with the Pharmacy & Poisons Board and health ministries simplify market entry. PMC

-

Opportunity to capture donor & regional markets — when a manufacturer achieves recognized quality marks (WHO PQ or equivalent), governments and large purchasers can buy locally, sometimes even export to neighbouring countries. WHO’s recent approvals for African sites demonstrate this pathway. World Health Organization

Cons & real risks (why local production is hard)

-

High upfront capital & working-capital needs — RDT production requires cleanrooms, lamination, nitrocellulose membranes, conjugate preparation lines, cold-chain for certain inputs and significant working capital to buy raw materials and finance inventory. Expect heavy CAPEX and 6–18 months to production unless you contract manufacture with an experienced partner. Operon

-

Quality is non-negotiable — regulatory & procurement gates — major purchasers (WHO, Global Fund, PEPFAR, national programmes) typically require WHO prequalification or stringent regulatory authority acceptance. Without robust QA/QC, you won’t sell at scale — or you’ll face recalls. Recent global efforts show WHO and partners are enabling African sites, but the bar remains high. World Health Organization+1

-

Cost pressures and price competition — global commoditised RDT prices (especially for huge COVID, malaria or pregnancy tests) are low; new local entrants face strong price pressure from established Asian manufacturers unless they can compete on quality + logistics + preferential procurement. Case studies show late entrants sometimes struggle to secure market share. marketaccess.africa

-

Input dependency — many critical raw materials (membranes, conjugates, colloidal gold, plastics, reagents) are still sourced abroad; single-sourcing or customs delays can stop lines. Localizing those upstream inputs is a longer industrial push. WHO | Regional Office for Africa

-

Regulatory complexity & capacity needs — manufacturers must meet Kenya’s Pharmacy & Poisons Board requirements and eventually the WHO prequalification or other international certs if they want donor markets. That requires quality systems (ISO 13485, GMP), validation studies and internal QC labs. PMC+1

Kenya case study — what happened (short narrative + lessons)

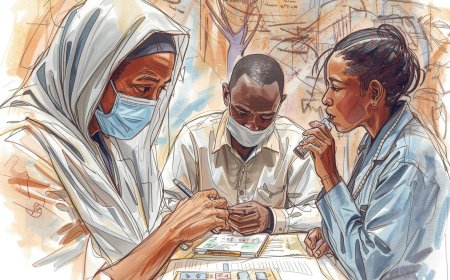

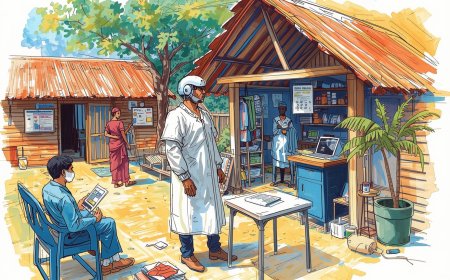

In 2024 a private firm launched an end-to-end RDT production plant in Kilifi, billed as one of the first such facilities in Sub-Saharan Africa with the capacity to produce millions of kits monthly. The project was co-funded by international development partners and aimed to supply regional markets as well as domestic needs. Kenya’s existing pharma/manufacturing base (Universal Corp and others) and active research partners (KEMRI) make the country a plausible hub — but early commercial reports show that quality approval, market access and competitive pricing remain the gating factors for sustained uptake. Local partnerships with research institutes and early engagement with Kenya’s Pharmacy & Poisons Board have been crucial. Health Business+2The Standard+2

Key lesson: plant + capacity ≠ sales. Manufacturers must plan QA, validation studies, regulatory milestones and buyer relationships well before full scale-up. MarketAccess case analyses of African-made COVID RDTs highlight distribution and price competition as frequent stumbling blocks. marketaccess.africa

Quality & regulatory pathway — the short, action-oriented version for Kenya

-

Register business & factory with Kenyan authorities (Business Registration Service; National Environment Management Authority if needed) and get local permits.

-

Engage Pharmacy & Poisons Board (PPB) early — PPB regulates diagnostics under the Pharmacy & Poisons Act and issues import/manufacturing guidance; pre-submission meetings reduce surprises. PMC+1

-

Set up Quality Management System (QMS) — ISO 13485, documented SOPs, batch records, stability testing, incoming raw-material testing.

-

Conduct performance & clinical validation — analytical sensitivity/specificity, lot-to-lot variation, field performance studies in local settings (peer literature shows sensitivity/specificity vary by brand and use context). ScienceDirect+1

-

Pursue WHO Prequalification or SRAs if you target donor tenders or cross-border sales — WHO packaging/shipping approvals and PQ milestones for African sites are now possible but require documentation and inspections. World Health Organization+1

-

Maintain pharmacovigilance/PSUR-style surveillance — adverse event reporting, lot tracking and rapid recall plans are essential for buyer confidence.

-

Negotiate procurement channels — national tenders, county purchases, private market, and donor procurements have different timelines and payment terms. Plan cashflow accordingly. industrialization.go.ke+1

Practical manufacturing checklist (use this in your board packet)

-

Business plan: 3-year revenue and cashflow models (pessimistic/optimistic).

-

CAPEX list: cleanrooms, laminators, cassette assembly lines, conjugate prep, QC labs, packaging machines.

-

Raw-material mapping: membranes, conjugates, colloidal gold, pads, antibodies, buffers — suppliers, MOQs, lead times.

-

QMS: ISO 13485 checklist, SOPs, batch records.

-

Validation plan: analytical validations + field performance studies (protocols + sample sizes).

-

Regulatory plan: PPB submissions, WHO PQ roadmap (if targeting donors).

-

Sales pipeline: MoH relationships, county health directors, private lab networks, e-pharmacies and distributors.

-

Logistics: warehousing, freight, export paperwork.

-

Financing: bridge capital for 6–12 months working capital and contingency.

-

HR & training: lab techs, QC chemists, regulatory officer, production operators.

-

Risk register: input shortage, customs delays, price undercutting, QC failure — with mitigations.

Financial & procurement realities (what donors and buyers actually want)

Donors and large buyers prioritize quality, price, and reliable delivery. Historically, low unit price wins tenders — so local manufacturers must either be price-competitive or offer additional value (nearby warehousing, faster delivery, localized technical support, or bundled services). UNITAID/FIND and WHO programs are creating windows for regionally-made diagnostics, but buyers often still require WHO PQ or evidence of equivalent stringency. Early commercial case studies show local firms benefit when they secure guaranteed off-take agreements (public procurement or anchor clients). finddx.org+1

12–18 month practical roadmap for a Kenyan RDT startup

Month 0–3: Feasibility & partner building

-

Finalise business plan; secure anchor partners (research institute, county health office, donor letter of interest). Map raw-material suppliers. KEMRI

Month 3–6: Facility & QMS set-up

-

Fit out production space, hire QC staff, implement ISO-style QMS, draft SOPs and batch documentation.

Month 6–9: Prototype & analytical validation

-

Produce pilot lots; run analytical tests (LOD, specificity); refine processes.

Month 9–12: Field performance & regulatory submission

-

Run field performance studies in representative Kenyan facilities; prepare PPB dossier. Start WHO PQ conversations if donor/ export plans exist. World Health Organization+1

Month 12–18: Scale & commercial launch

-

Scale production, complete regulatory approvals, secure procurement agreements (county, private, donor) and ramp up distribution.

Final recommendations — a TL;DR for decision-makers

-

If your goal is health security and you have anchor buyers (government/donor), local manufacturing is strategically sensible — it reduces supply risks and creates economic value. But plan for high upfront cost, sustained QA and donor-grade validation. WHO | Regional Office for Africa+1

-

If you’re chasing margin in commoditised RDTs without guarantees, consider contract manufacturing or regional partnerships first — build relationships, then invest in a factory once you secure predictable off-take. MarketAccess analyses show late entrants without distribution wins struggle. marketaccess.africa

-

Engage regulators and partners early (PPB, KEMRI, FIND/Unitaid, WHO) — they can shorten timelines and point you to funding/technical support opportunities for tech transfer. KEMRI+2finddx.org+2

References (APA — live links)

FIND. (n.d.). Regional manufacturing. FIND / Unitaid technology-transfer and manufacturing support for diagnostics. https://www.finddx.org/what-we-do/cross-cutting-workstreams/regional-manufacturing/. finddx.org

World Health Organization. (2024, December 12). WHO approves packaging and shipping of a prequalified HIV rapid test at African manufacturing site. https://www.who.int/news/item/12-12-2024-WHO-approves-packaging-and-shipping-of-a-prequalified-HIV-rapid-test-at-African-manufacturing-site. World Health Organization

Revital Healthcare. (2024, May). Revital launches Africa’s first end-to-end rapid diagnostic manufacturing facility (Kilifi, Kenya). https://revitalhcare.com/2024/05/09/africas-largest-rapid-test-kit-production-facility/. revitalhcare.com+1

MarketAccess Africa. (2024). Supporting the commercialization of an African-made COVID-19 diagnostic kit (case study). https://www.marketaccess.africa/case-studies/supporting-the-commercialization-of-an-african-made-covid-19-diagnostic-kit. marketaccess.africa

WHO Regional Office for Africa. (2024). Framework for strengthening local production of medicines, vaccines and other health technologies in the WHO African Region (AFR-RC74-6). https://www.afro.who.int/sites/default/files/2024-07/AFR-RC74-6%20Framework%20for%20strengthening%20local%20production%20of%20medicines%2C%20vaccines%20and%20other%20health%20technologies%20in%20the%20WHO%20African%20Region.pdf. WHO | Regional Office for Africa

Onsongo, S. N., et al. (2021). Performance of a rapid antigen test for SARS-CoV-2 in Kenya. Clinical Infectious Diseases / PLOS (selected studies). https://pmc.ncbi.nlm.nih.gov/articles/PMC8558097/. PMC

Kenya Industrialization / Investment Office. (n.d.). Opportunities — Manufacture of Rapid Diagnostic Test Kits. https://opportunities.invest.go.ke/opportunities/opportunity/manufacture-of-rapid-diagnostic-test-kits. opportunities.invest.go.ke

Baldeh, A. O., et al. (2023). Bridging the gap? Local production of medicines on the African continent. Health Policy and Planning. https://pmc.ncbi.nlm.nih.gov/articles/PMC9886419/. PMC

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0