Monetization Models for Teleconsultation Startups in Africa: From Micro-Payments to Subscriptions

A practical, Africa-focused playbook for monetizing teleconsultation platforms. Covers pay-per-consult micro-payments, subscriptions (B2C, B2B, employer/insurer), marketplace and commission models, integrations with mobile money, pharmacy & diagnostics revenue plays, value-added services, unit-economics templates, pilot pricing tests, regulatory and risk considerations, and copy-paste SMS & pricing examples. Includes African case studies, witty anecdotes, and APA citations with live links.

Short brief: Teleconsultation startups in Africa face a unique mix of opportunity and constraint — huge unmet demand, fast mobile-money adoption, fragmented payer systems, and cautious willingness-to-pay. This guide lays out the realistic business models that actually work on the continent, the implementation mechanics you must get right, quick unit-economics checks, and the regulatory & operational pitfalls that kill margins. Expect examples you can copy, a tiny financial model you can paste into a slide, and a couple of rib-cracking founder anecdotes to keep finance boring-but-fun.

Opening anecdote (founder truth)

A founder in Lagos told investors: “We launched free teleconsults to build users. After two months the product team loved the KPI dashboards — and the finance team fainted.” Lesson: traction is sexy, cash is oxygen. Plan monetization early, test fast, and don’t assume donors will pay forever.

The African payment reality — why monetization is possible (and different)

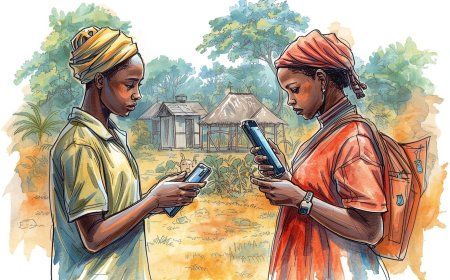

Mobile money and mobile wallets already make pay-per-consult realistic across Africa. Mobile money registered accounts and usage continue to surge, creating dependable rails for tiny payments and subscriptions. But many users remain price-sensitive; public procurement and insurers are still patchy. Build mixed revenue streams — consumer micro-payments + B2B contracts + value services — for resilience. GSMA+1

Quick taxonomy: 10 monetization models that work (with pros/cons)

-

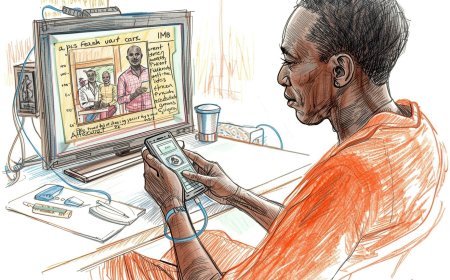

Pay-per-consult (micro-payments)

-

How: Patient pays per consultation (SMS or mobile money paywall before session). Typical pricing ranges widely (US$1–10) depending on country, clinician level, and service type.

-

Pros: Simple to test, aligned to value delivered, immediate cashflow.

-

Cons: Low revenue predictability, high churn, customer acquisition cost (CAC) sensitivity.

-

Fit: Urban/self-pay users, acute consults, first pilots.

-

-

Consumer subscriptions (B2C)

-

How: Monthly/annual plan for unlimited or X consultations + perks (priority booking, discounts on meds). Example: $3–10/month ARPU target for mid-income markets.

-

Pros: Predictable recurring revenue, easier LTV forecasting.

-

Cons: Requires clear stickiness and value (chronic care, maternal care).

-

Fit: Chronic disease cohorts, corporates’ employee families.

-

-

Employer / B2B subscriptions

-

How: Employers buy telehealth packages per employee (per-employee-per-month, e.g., $0.5–$5/employee/month).

-

Pros: Lower CAC, contract stability, faster scale in formal sectors.

-

Cons: Sales cycle longer; HR procurement hurdles.

-

Example: Health benefits packaged into payroll or SME affordability programs.

-

-

Insurer reimbursement / payors (B2I)

-

How: Integrate with private insurers or national social schemes; bill per consult or as part of capitation.

-

Pros: Larger ticket sizes, lower out-of-pocket friction for users.

-

Cons: Requires compliance, coding, claims processing and approvals; slow sales cycles.

-

Fit: Countries with mature private insurance or government telehealth tenders (e.g., public contracts like Babyl in Rwanda). PMC

-

-

Marketplace & commission model

-

How: Platform connects patients and clinicians; platform takes a commission per booking (e.g., 10–25%).

-

Pros: Asset-light, scalable, network-effects.

-

Cons: Quality control, two-sided liquidity and margin pressure.

-

Fit: Urban markets with many independent providers.

-

-

SaaS to clinics / Hardware + software bundles (Helium-style)

-

How: Sell EMR/booking/teleconsult software subscriptions to clinics and hospitals; add teleconsult module as a paid add-on.

-

Pros: B2B recurring revenue, less CAC per clinician.

-

Cons: Implementation/customization overhead.

-

Example: Helium Health’s clinic SaaS + HeliumDoc teleconsult features. Vizologi+1

-

-

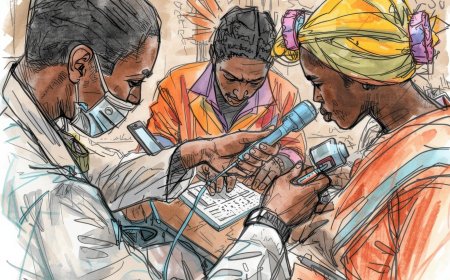

Pharmacy & diagnostics capture (vertical revenue)

-

How: Teleconsult platform earns referral/fulfilment fees when patients buy medicines (e-pharmacy) or tests. Monetise via commissions, margin on goods, or fulfillment fees.

-

Pros: High margin add-ons, better unit economics per consult.

-

Cons: Inventory & regulatory challenges; need partnerships (MyDawa, mPharma examples). TechCrunch+1

-

-

Value-added premium services (case management, RPM, chronic care bundles)

-

How: Charge higher ARPU for monitored chronic care (remote monitoring devices, nurse follow-ups, care navigators).

-

Pros: Higher LTV and lower churn for chronic patients.

-

Cons: Requires care teams and device logistics.

-

-

Advertising / sponsored content & data licensing (careful)

-

How: Non-clinical ads, curated pharma sponsorships, anonymized aggregated analytics sold to partners.

-

Pros: Additional revenue stream.

-

Cons: Ethical, legal (data protection), credibility risks — use cautiously and transparently.

-

-

Outcome-based & shared-savings contracts

-

How: Contracts with payors/government where you share savings from avoided admissions or reduced referrals.

-

Pros: Large upside, aligned incentives.

-

Cons: Hard to measure, requires robust data & trust; long negotiation cycles.

-

Example mixes that actually scale (realistic bundles)

-

Consumer + Pharmacy Combo: $3 subscription/month + 20% commission on any e-pharmacy orders (improves ARPU and retention). (See MyDawa & MyDawa funding growth as evidence of demand for combined services). TechCrunch+1

-

SaaS + Marketplace: Clinic EMR subscription $200/month + 15% marketplace commission on teleconsult bookings via platform. (Helium Health model shows B2B SaaS reliability while teleconsult captures marketplace fees). Helium Health

-

Employer + RPM: Employer pays $2/employee/month for teleconsult + $1 extra for RPM for high-risk employees (care bundles reduce absenteeism — sell ROI to HR).

Simple unit-economics sanity check (small worked example) — compute carefully

Assumptions (example market):

-

CAC (customer acquisition cost) per consumer user = US$8.00.

-

Monthly subscription price = US$3.00 (B2C basic plan).

-

Gross margin on subscription = 80% (digital service; payment fees take ~20%).

-

Monthly churn = 5% (so average lifetime ≈ 1 / 0.05 = 20 months).

Step-by-step calculations:

-

Monthly net revenue per user = price × margin = $3.00 × 0.80 = $2.40.

-

Estimated Lifetime Value (LTV) = monthly net × average lifetime = $2.40 × 20 = $48.00.

-

Payback period (months) = CAC / monthly net = $8.00 / $2.40 = 3.333... months → round to 3.3 months.

Interpretation: with these assumptions, CAC is recovered in ~3.3 months and LTV/CAC ≈ $48 / $8 = 6x, a healthy multiple. If churn rises to 10% (lifetime = 10 months) LTV becomes $24 and LTV/CAC = 3x — still OK but closer to the margin. Always stress-test with higher churn, higher payment fees, and occasional subsidies. (You should run this exact calc with your own numbers.)

Payments and collection mechanics — technical tips

-

Mobile money first: Integrate M-Pesa, MTN MoMo, Airtel Money — these are the dominant rails for micropayments in many African markets. GSMA data shows explosive mobile-money penetration supporting micro-billing. GSMA

-

Wallets & prepaid bundles: Allow top-ups (wallet in app) and auto-renew with SMS confirmation.

-

Aggregators & payment gateways: Use local PSPs (Flutterwave, Paystack) for card, bank transfers, and wallet aggregation. Negotiate lower per-transaction fees for recurring billing.

-

Offline vouchers & coupon codes: Useful for CHW-mediated enrollments or donor-subsidized credits.

-

Collections & refunds: Clear refund policies, charge only after consult completes (or require nominal pre-auth to reduce no-shows) and reconcile daily with payouts.

Cite payment partners / market evidence: GSMA mobile money; PSP pages for technical integration (Flutterwave/Paystack). gsmaintelligence.com

Pricing experiments — how to test willingness-to-pay (fast)

-

A/B price testing: show two price points in parallel acquisition channels and measure conversion.

-

Anchor with bundles: offer “first consult free + $X/month” vs “pay-per-consult only” and compare retention.

-

Discount coupons via CHWs to test rural willingness to pay.

-

Use employer trials with pilot cohorts to validate B2B pricing before scaling.

Important: always get IRB/ethics approval if price experiments could differentially affect care access.

Regulatory, ethical & operational red flags

-

Regulation of e-prescribing & pharmacies: If you monetize via pharmacy fulfillment, ensure you partner with compliant e-pharmacies and follow national rules (registrations, tamper-proof e-scripts). Examples: MyDawa, mPharma show model viability but also regulatory complexity. mpharma.com+1

-

Insurance contracting & claims: Billing insurers requires codes, SLAs, secure audit trails — build the capability or partner with intermediaries. Babyl-style government contracts show public payor routes can scale user numbers quickly. PMC

-

Data privacy when monetizing analytics/ads: Aggregate & anonymize before sharing; follow data protection laws (e.g., Kenya’s DPA) and be transparent with users.

-

Price gouging & equity: Avoid pricing models that lock out low-income patients; consider cross-subsidies, donor vouchers, or social tariffs.

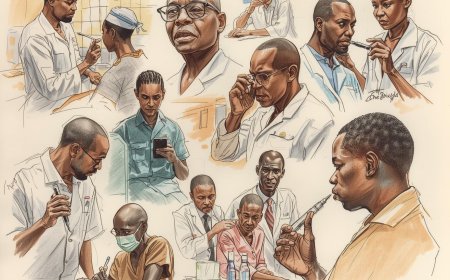

Sales channels & distribution — how to acquire paying users cheaply

-

CHW & clinic partnerships — enrol chronic patients through clinics (lower CAC).

-

Employer HR partnerships — sell B2B where procurement budgets exist.

-

Pharmacy/retail cross-sell — co-promote teleconsults at point of care.

-

Telco bundles — zero-rating app data or co-marketing with mobile operators.

-

Insurer & benefits platforms — get on the insurer’s preferred-provider list.

-

Content & trust marketing — health education + free triage can convert to paying users (teach the product value).

Operational checklist before you charge money (do this first)

-

MVP validated (clinical safety + basic UX).

-

Payment rails integrated and tested with settlements.

-

Receipts, refunds, and reconciliations automated.

-

Customer support trained for billing disputes.

-

Legal reviews for consumer protection, invoicing, and tax compliance.

-

KPIs defined: CAC, ARPU, churn, LTV, payback period.

Pitfalls & survival tips (short and punchy)

-

Don’t rely on a single revenue stream. Mix consumer + B2B + vertical capture.

-

Measure CAC by channel. Some channels (employer sales) have far higher conversion but also longer cycles.

-

Expect slow insurer/government sales cycles. Use consumer/ employers to bridge cashflow.

-

Be honest about price elasticity. Small increases can collapse conversion in price-sensitive markets. Test, don’t guess.

-

Plan for collections & fraud. Mobile money chargebacks and false claims need operational processes.

Case studies & evidence (Africa examples)

-

Babyl Rwanda (government contract): Rwanda’s public-private deployment of Babyl (Babylon’s Rwanda arm) shows how government contracts / insurance payment models can rapidly scale virtual care when the payor (government) covers consult fees. This is a model for countries with centralized schemes. PMC+1

-

MyDawa (Kenya): MyDawa succeeded by combining e-pharmacy fulfilment and digital pharmacy services; fundraising and growth show the monetization potential of integrating teleconsult + pharmacy capture. Their funding rounds and marketplace playbook illustrate vertical capture value. TechCrunch+1

-

mPharma (regional supply + subscription): mPharma monetizes through subscriptions and supply contracts with pharmacies and clinics — demonstrating the strength of B2B recurring revenue in the pharmaceutical stack. mpharma.com+1

-

Helium Health (SaaS + teleconsult): Helium Health combines clinic SaaS, bookings and teleconsult features (HeliumDoc), illustrating a B2B+marketplace bundle that stabilises revenues with recurring SaaS income. Helium Health+1

Quick go-to pricing playbook (copy into your pitch deck)

-

Launch pilot with pay-per-consult: price 1.5× median outpatient visit in target city but ≤ perceived alternative (e.g., taxi + clinic wait).

-

Offer a “chronic care subscription” at 10–15× expected monthly consult frequency to capture LTV.

-

Sell employer pilots at per-employee per-month with 3-month trials.

-

Integrate pharmacy fulfilment commission from Day 1 to lift ARPU.

-

Track and publish metrics monthly; iterate pricing and bundles every 30–90 days.

References (APA, live links)

Agbeyangi, A. O. (2025). Telemedicine adoption and prospects in sub-Sahara Africa: Systematic review. PMC. https://pmc.ncbi.nlm.nih.gov/articles/PMC11989057/. PMC

MyDawa. (2023, July 3). Kenya’s MyDawa aims to be an all-in-one health platform. TechCrunch. https://techcrunch.com/2023/07/03/kenyas-mydawa-aims-to-be-an-all-in-one-health-platform-backed-by-20-million-funding/. TechCrunch

mPharma. (2021). Annual Impact Report. https://mpharma.com/wp-content/uploads/2022/04/Impact-Report-_mPharma-2021.pdf. mpharma.com

Müller, A., et al. (2022). Digital mHealth and virtual care use during COVID-19 in Africa: Case of Babyl Rwanda & lessons. PMC. https://pmc.ncbi.nlm.nih.gov/articles/PMC9714961/. PMC

GSMA. (2025). Mobile money surpasses two billion registered accounts. https://www.gsma.com/newsroom/press-release/mobile-money-surpasses-two-billion-registered-accounts-and-over-half-a-billion-monthly-active-users-globally/. GSMA

Helium Health. (n.d.). HeliumDoc and Helium Health solutions. https://heliumhealth.com/. Helium Health

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0