Scaling Manufacturing: Choosing Local vs Overseas Contract Manufacturers for MedTech & Wearables

A practical, Africa-first guide for medtech founders and device teams deciding whether to scale with a local contract manufacturer (CMO) or send production overseas. Covers cost & time trade-offs, regulatory & quality requirements (ISO 13485 / MDSAP), IP and supply-chain risks, incentives (Kenya / South Africa), procurement/RFP checklist, a decision framework, Kenya case study (Revital), and a 12-month playbook for pilots → scale. Includes investor-ready checklists and APA citations with live links.

Short brief: When your prototype graduates from the lab and investors start asking “who’s making this?”, you need a crisp answer: local CMO or overseas partner? Both routes work — but they carry different trade-offs in cost, time-to-market, quality control, regulatory lift, and political/operational risk in African contexts. This article gives product teams, procurement leads and founders a decision framework, witty real-world anecdotes, a Kenya case study, and copy-paste RFP clauses so you can choose and act — fast.

Opening anecdote (because someone has to laugh first)

A founder once celebrated a cheap, shiny box of 5,000 wearables made overseas. Boxes arrived on a Friday; customs held them until Monday — but not before six units had saltwater damage from a poorly sealed pallet. The founder texted investors: “Good news — we have inventory!” They replied: “Bad news — nobody can use it.” Moral: the cheapest quote is not the one that lands on hospital shelves.

Why this choice matters (short)

Choosing between local vs overseas CMOs affects: time to first sale, per-unit cost, quality/certification burden, intellectual-property (IP) risk, supplier resilience, and political optics (local jobs → easier procurement). Global players (WHO, Unitaid, FIND) are pushing African local production — but local capabilities are uneven and incentives differ by country. Plan with numbers, not feelings. WHO | Regional Office for Africa+1

Quick comparison — the one-page tradeoff

Local CMO (Kenya / South Africa / regional)

-

Pros: Faster iterations and site visits; easier regulatory engagement & local registration; potential tax/SEZ incentives; better political optics and faster customs; shorter logistics & lower ocean-freight risk. Invest Kenya+1

-

Cons: Higher per-unit costs at low volumes; limited upstream suppliers for components (membranes, chips); QA capacity may be inconsistent — check ISO 13485 / MDSAP readiness; potential capacity constraints for scale. iej.org.za+1

Overseas CMO (Asia / Eastern Europe)

-

Pros: Lower per-unit cost at scale, deep component supply base, mature QC and certifications, faster ramp to high volumes. Quasar Med

-

Cons: Longer lead times, customs & FX risk, IP & quality-control management more complex, slower engineering change cycles, higher shipping and duty. Meridian Medical+1

(Use the decision flow below to choose — don’t guess.)

Decision framework — five questions that decide it for you

-

How soon do you need to iterate? If you expect frequent engineering changes (firmware/hardware tweaks) during early production, local CMOs shorten feedback loops and reduce expensive overseas air-freight for iterations.

-

What certifications does your buyer require? Donor tenders / Global Fund / WHO PQ often require MDSAP/ISO 13485 evidence and tight QA. If you need MDSAP/CE/FDA quickly, an experienced overseas CMO may already have them. U.S. Food and Drug Administration+1

-

Can you secure reliable components locally or regionally? If key subcomponents are imported, local assembly still depends on global suppliers — check lead times and single-source risks. iej.org.za

-

What’s your unit economics at pilot vs scale? Run the numbers for cost-per-unit (CPU) at 1k, 10k, 100k units for both options including shipping, tariffs, QC rework, and returns.

-

What regulatory and procurement advantages exist locally? Some governments (Kenya, South Africa) offer tax breaks, SEZ benefits, or procurement preference for local manufacturers; these can change the CPU calculus. Invest Kenya+1

If you answered “fast iterations”, “local procurement advantages”, or “supply-chain resilience” → favour local CMO. If you answered “need low CPU at >50k units” or “need existing CE/FDA infrastructure” → consider overseas CMO.

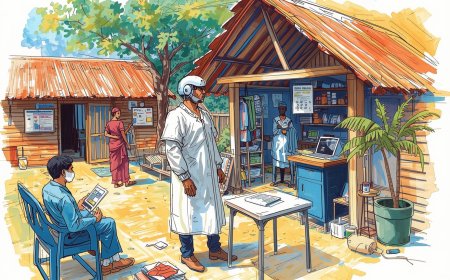

Case study: Kenya — Revital Healthcare shows what local scale looks like

Kenya’s Revital Healthcare launched a large RDT / device manufacturing facility in Kilifi and has positioned itself as a regional supplier — proving local capacity growth with government and donor support. Their success required early regulatory engagement, international QA certifications, and partnerships for raw materials and tech transfer. The Revital example shows local manufacturing can work when anchored by anchor-buyers (govt / donors), finance, and technical partners. revitalhcare.com+2Health Kenya+2

Lesson: local manufacturing paired with validated QA systems and anchor procurement is a viable path — but it requires upfront regulation, finance, and supply linkages.

Regulatory & quality checklist (non-negotiables)

Whether local or overseas, insist the CMO can demonstrate:

-

ISO 13485 quality-management registration or active plan to achieve it. ISO

-

MDSAP readiness or audit trail if you plan to sell to major markets or donor programs — MDSAP reduces multiple audits. U.S. Food and Drug Administration

-

Documented device history records, batch records, incoming material testing and lot traceability.

-

Regulatory support: ability to generate technical file for CE/UKCA/510(k)/local registration (PPB in Kenya, SAHPRA in South Africa). For Kenya, check the Pharmacy & Poisons Board device registration pathways. web.pharmacyboardkenya.org+1

-

Post-market surveillance (PMS) capability and recall procedures.

If a local CMO lacks ISO 13485 now, ask for a documented remediation plan with milestones and penalties in the contract.

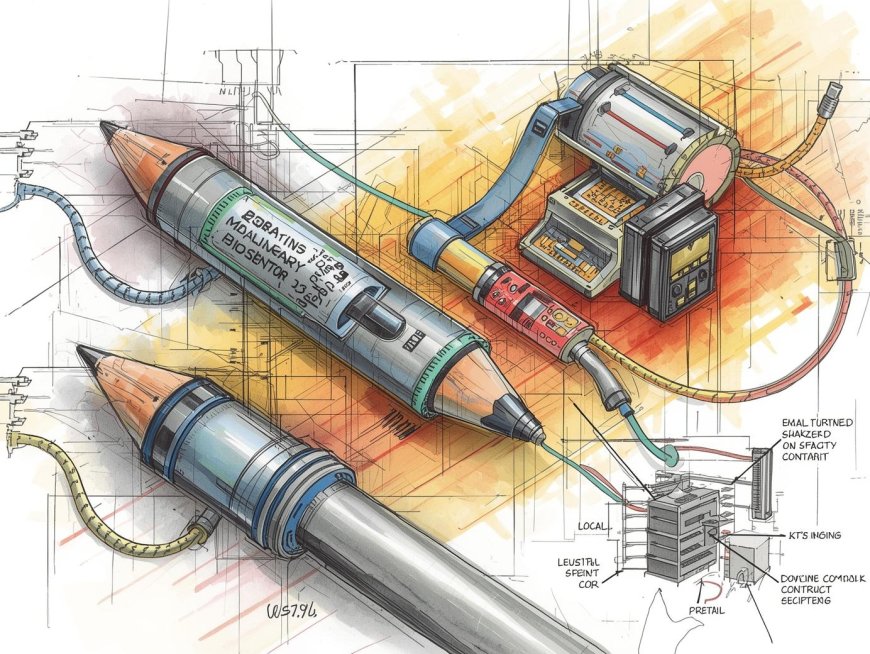

Supply-chain & component sourcing realities

-

Many semiconductor chips, membranes, sensors and adhesives are global commodities — both local and overseas CMOs may need the same upstream vendors. Assess single-supplier risk (MOQ, lead time). FIND/Unitaid and WHO regional manufacturing programs have built tech-transfer routes for diagnostics, but manufacturers still rely on global inputs. Unitaid+1

-

Duty, VAT, and customs paperwork vary by country — using a local CMO often reduces import cycles for finished goods, but components may still get stuck at port. Use bonded warehousing and work with experienced customs brokers.

-

Consider hybrid models: local final assembly and QA with overseas supply of complex subassemblies (PCBs, optical modules). This often gives the best of both worlds.

IP & data security (bite-sized guidance)

-

Overseas CMOs: insist on strong contractual IP clauses — ownership of tooling, firmware escrow, NDAs, and limits on second-sourcing. Include code-obfuscation and hardware locking where reasonable.

-

Local CMOs: easier face-to-face IP discussions and faster dispute resolution, but be equally explicit about tooling ownership and know-how transfer.

-

For both: use an escrow for firmware and BOM, and ensure code signing keys are controlled by you (not the factory) unless explicitly contracted.

Cost model — what to include in your CPU calculation (don’t forget these hidden items)

Per-unit cost should include:

-

CMO per-unit manufacturing labor & overhead

-

Tooling amortisation (molds, injection tools) allocated across units shipped

-

Incoming component costs and tariffs / duties

-

QC rework & scrap rates (use conservative 5–10% for pilots)

-

Shipping, insurance, customs clearance, and local logistics to warehouses

-

Certification & audit costs per year (ISO, MDSAP, CE/FDA technical file support)

-

Warranty and RMA handling costs

-

Working capital impact (days payables vs receivables) — overseas suppliers often require deposits or LC which affects cashflow.

Make a 3-scenario model (pilot 1–5k / scale 10–50k / mass >100k) and place both local & overseas quotes side-by-side.

Procurement & contracting: RFP checklist for CMOs (copy-paste ready)

Must-have RFP items:

-

Company profile, ISO 13485 certificate (or current remediation plan), MDSAP status. ISO+1

-

Minimum order quantities, lead times (prototype → pilot → mass), escalation capacity and max monthly throughput.

-

Tooling quotes, amortization schedule, and who owns tooling at contract end.

-

Detailed BOM sourcing plan — local vs imported parts, approved suppliers list, and long-lead-time parts mitigation.

-

QC process, inspection criteria, incoming inspection and sample lot test plan.

-

Traceability & serialisation capability (UDI readiness if required).

-

Regulatory support: dossier assembly, testing labs, and support for local registrations.

-

Warranty, RMA turn-around times, and spare-part availability commitments.

-

IP & confidentiality clauses, escrow arrangements for firmware and drawings.

-

Price schedule (pilot volumes / million-unit tiers), payment terms, penalties for late delivery and unjustified quality failures.

-

Factory audit access & right to perform 3rd-party audits.

-

Environmental / disposal practices (battery / e-waste) and CSR details.

Operational governance — how to run a CMO relationship (practical)

-

Monthly KPIs: yield, scrap rate, on-time delivery, number of NCs (non-conformances), audit findings closed.

-

Change control board (CCB): every ECO (engineering change order) goes through a CCB with CMO attendance; freeze software/hardware versions before pilot runs.

-

First Article Inspection (FAI): define FAI criteria (visual, functional, electrical) and accept/reject rules before mass run.

-

Pilot acceptance tests: number of units sampled and tests to pass (electrical, environmental, basic performance).

-

Warehouse & reverse logistics: define who holds spares and how returns are handled.

Hybrid strategy that often wins: design & early builds local; scale overseas

Many African medtech teams use a hybrid approach:

-

Design for manufacturability (DFM) and small pilot runs with a local CMO for rapid iteration and regulatory interactions.

-

Once design is frozen and certifications nailed, move high-volume production to an experienced overseas CMO (or keep final assembly local while subassemblies come from overseas).

This gives fast learning and local procurement advantages while keeping scale economics.

12-month pilot→scale playbook (milestones & who-owns-what)

Months 0–2 — CMO selection & audits

-

Issue RFP to 4–6 shortlisted CMOs (mix local & overseas). Run desk reviews, then 1–2 day factory audits. Sign NDA + sample tooling agreements. (Owner: Product + Ops)

Months 3–4 — Prototype / pre-pilot build

-

Tool small run (n=200–1,000); run FAI; perform environmental and functional tests. (Owner: Engineering + QA)

Months 5–7 — Pilot & regulatory push

-

Deploy pilot (n=1,000–5,000). Collect field data, ramp QA processes, start local registrations (PPB / SAHPRA / other). (Owner: Clinical + Regulatory)

Months 8–10 — Decide scale & sign long-term contract

-

Compare costs & QC. If moving overseas, sign long-term CMO contract with tooling transfer terms and local final-assembly or spares plan. (Owner: CEO + Legal + Procurement)

Months 11–12 — Scale ramp & audits

-

Ramp production, perform MDSAP/ISO audits, finalise logistics & bonded warehousing. Launch. (Owner: Ops + QA)

Quick risk matrix & mitigations

-

Risk: Customs detention of final goods → Mitigation: local CMO or bonded import + customs broker.

-

Risk: CMO fails quality → Mitigation: required ISO 13485 + right to audit + vendor penalty clauses. ISO

-

Risk: IP leakage → Mitigation: tooling ownership clauses, escrow, technical obfuscation.

-

Risk: Component shortage → Mitigation: BOM dual-sourcing, safety inventory, local substitutes testing.

-

Risk: Cashflow squeeze → Mitigation: staged payments, local incentives, working-capital loans, or reagent-rental models for instruments.

Practical checklist you can use in 48 hours

-

Build 3-scenario CPU model (pilot / scale / mass) including duty, shipping, inspections and rework.

-

Run RFP to 2 local + 2 overseas CMOs using the RFP checklist above.

-

Schedule factory audits and request ISO 13485 + MDSAP evidence. ISO+1

-

Check national incentives (SEZ, tax breaks) with Invest Kenya / dtic (SA) to factor into economics. Invest Kenya+1

-

Draft tooling ownership, quality KPIs, and escrow clauses for legal review.

References (APA — live links)

World Health Organization. (2024). Framework for strengthening local production of medicines, vaccines and other health technologies in the WHO African Region (AFR-RC74-6). https://www.afro.who.int/sites/default/files/2024-07/AFR-RC74-6%20Framework%20for%20strengthening%20local%20production%20of%20medicines%2C%20vaccines%20and%20other%20health%20technologies%20in%20the%20WHO%20African%20Region.pdf. WHO | Regional Office for Africa

Revital Healthcare. (2024, May 9). Africa’s largest rapid test kit production facility (Kilifi, Kenya). https://revitalhcare.com/2024/05/09/africas-largest-rapid-test-kit-production-facility/. revitalhcare.com

FIND. (n.d.). Regional manufacturing — FIND diagnostic technology transfer and manufacturing support. https://www.finddx.org/what-we-do/cross-cutting-workstreams/regional-manufacturing/. finddx.org

Unitaid. (2024). Regional manufacturing strategy (diagnostics & tech transfer). https://unitaid.org/uploads/Regional-Manufacturing.pdf. Unitaid

Kenya Investment Authority / Invest Kenya. (n.d.). Investment incentives and SEZ benefits. https://www.investkenya.go.ke/incentives/. Invest Kenya

South Africa Department of Trade, Industry & Competition (the dti). (2023). A guide to incentive schemes (SEZ & others). https://www.thedtic.gov.za/wp-content/uploads/the-dtic-incentive-schemes-guide-2023-24.pdf. thedtic.gov.za

Pharmacy & Poisons Board (Kenya). (2022). Guidelines for Registration of Medical Devices Including In-Vitro Diagnostics. https://web.pharmacyboardkenya.org/download/guidelines-for-registration-of-medical-devices-including-in-vitro-diagnostics/. web.pharmacyboardkenya.org

ISO. (2016). ISO 13485:2016 — Medical devices — Quality management systems. https://www.iso.org/standard/59752.html. ISO

U.S. Food & Drug Administration. (n.d.). Medical Device Single Audit Program (MDSAP). https://www.fda.gov/medical-devices/cdrh-international-affairs/medical-device-single-audit-program-mdsap. U.S. Food and Drug Administration

Meridian Medical. (2022). The pros and cons of reshoring your medical device manufacturing. https://www.meridian-medical.com/the-pros-and-cons-of-reshoring-your-medical-device-manufacturing/. Meridian Medical

Quasar Medical / Quasar guides. (n.d.). Choosing a low-cost country for medical device manufacturing — pros & cons. https://quasarmedical.com/education/low-cost-country-for-medical-device-manufacturing/. Quasar Med

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0