Runway Doesn’t Matter Without Revenue — Why Healthtech Startups Must Chase Patients, Not VCs

Investors won’t save a product that no one pays for. This opinion-review argues that for medical and healthcare startups — especially in low-resource settings — the only sustainable funding strategy begins with a paying customer. Real-world scenarios, an author’s field experience, and practical, healthcare-specific tactics show how revenue-first founders build durable impact and investor confidence.

“Runway” is seductive. A big raise promises time to iterate, hire engineers, and ‘perfect’ the product. In healthcare — where regulatory friction, procurement cycles, and clinical risk are real — that seduction can be fatal. Chasing investors before customers drains momentum, eats culture, and often builds a business that looks great on a pitch deck but hollow on hospital floors.

I’ve mentored and built healthcare products in Nairobi and beyond (including hospital management systems and AfriHealth AI triage work). From that vantage, the thesis is simple and urgent: the only reliable funding strategy for healthtech is a paying customer.

Why revenue matters more than runway in healthcare

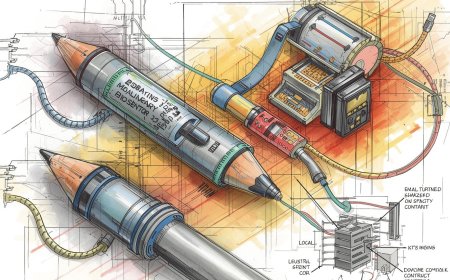

- Clinical validation and procurement move at different speeds. A paying customer forces you to solve real workflow, integration, privacy, and billing problems today — not at some hypothetical “product-market fit” three pivots from now.

- Revenue creates honest incentives. Free pilots and grant-funded pilots often obscure repeatability: teams learn how to get pilots, not how to sell and operate sustainably.

- Investors fund traction, not dreams. In healthtech, traction ≠ downloads; traction = committed contracts, purchase orders, reimbursement pathways, or recurring clinic payments.

Realistic scenarios (field-proven patterns)

- Small private clinics in Nairobi sign up for a low-cost teleconsult package and pay per consult. Those early payments reveal pricing tolerance, platform reliability issues, and collections realities — far more useful than vanity metrics. (This mirrors the approach used when deploying MHMIS and telemedicine services in regional deployments.)

- A county health department agrees to a 6-month paid pilot for an AI triage tool as part of nurse triage lines. Because money changes contractual rigor, the startup must satisfy data governance, uptime, training, and outcomes reporting — conditions that make the product investable later.

- Contrast: a startup that took two grants and one pre-seed to build a “perfect” product without selling. When fundraising stalled, the team had no customers, limited operational learning, and no negotiating leverage — investor interest evaporated.

Case study (practical, composite — anonymized)

A Kenyan healthtech team built a maternal health monitoring app. They ran several free pilots in public facilities and collected lots of usage data — but no paying contracts. When they attempted to commercialize, clinics reported workflow mismatches and unwillingness to shoulder recurring costs. The team then pivoted to a revenue-first model: offering the app bundled with training and a small, per-patient fee to private clinics and NGOs with program budgets. Within six months they achieved consistent monthly revenue, reduced churn, and finally raised a priced seed round because investors could model future payments. The moral: money early forced the startup to solve delivery, billing, and procurement problems they had been ignoring.

Practical playbook for revenue-first healthtech founders

- Start with a single paying buyer — a private clinic chain, NGO program, insurer, or government procurement unit. One repeatable buyer beats many pilots.

- Design contracts before product features. Build the minimal deliverable that satisfies contractual SLAs, compliance, and payment terms.

- Charge for value, not for features. Price per consult, per bed-day saved, per test processed, or as a subscription for access to data and dashboards. Link price to clinical or operational outcomes when possible.

- Ship to procurement realities. Hospitals buy with POs, timetables, and approval committees. Learn those cycles and sell into them.

- Use paid pilots as conversion funnels. Structure pilots as paid scoped engagements with clear KPIs and renewal clauses. Free pilots should be rare and tightly time boxed.

- Measure the business metrics VCs will care about. MRR, ARR, gross margin, CAC, LTV, churn, contract length, and collection days. Don’t hide messy numbers — improve them.

- Sell services early. Implementation, integration, training, and third-party hardware installation are valuable revenue lines that also reduce product risk.

- Negotiate milestone payments. For government or NGO deals, tie payments to deliverables and acceptance tests. That improves cash flow and accountability.

- Protect clinical credibility. Revenue must not come at the cost of patient safety or data privacy; a paid contract amplifies legal risk if you cut corners.

- Use revenue to de-risk fundraising. When you talk to investors, show committed revenue streams and predictable renewal behavior — that’s worth more than an extra month of runway.

For investors: reward founders who show customers first

Investors should tilt term sheets toward teams that demonstrate paying customers, even if the ARR is modest. Fund the operator who can close a PO and run ops in a district hospital, not only the founder who mastered seed-round slide decks. A smaller round for a revenue-generating company will generally produce more durable returns than a large round for a product that hasn’t faced procurement.

The special constraints of healthcare — and how revenue solves them

- Regulation: Paid customers force compliance work (data protection, clinical oversight) to happen early.

- Integration: Hospitals demand EMR/HMIS compatibility; paid integrations reveal hidden costs before scale.

- Liability: A paying client will demand indemnities and insurance; solving that early prevents fatal pivots later.

Final judgment

Runway is a comfort blanket; revenue is oxygen. For healthcare startups, paying customers—not investor term sheets—teach the team how to build something that hospitals will deploy, clinicians will adopt, and payers will reimburse. If your strategy begins with investors before you know how to collect payments for clinical value, you are building a theory of the company, not a company. Pivot that theory into practice: find a customer who will write a cheque.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0