Supply Chain: Sourcing Reagents and Consumables Reliably

Practical, Africa-focused playbook for reliably sourcing reagents and consumables for diagnostics and point-of-care tests. Covers supplier selection, procurement modalities (frameworks, reagent-rental, VMI), forecasting, cold chain & storage, customs and regulatory traps, local manufacture & pooled procurement (AMSP), risk mitigation, sample RFQ language, and operational checklists for labs, startups and MoH procurement teams. APA citations and live links included.

Short brief: Nothing grinds a diagnostic programme to a halt faster than “no reagents.” Whether you run a small POC lab, a diagnostics startup, or manage county-level procurement, this guide gives the real-world steps, checklists and templates you’ll use to keep tests running — without burning cash or accepting low-quality kits. Expect real African examples, a rib-cracking anecdote, and procurement copy you can paste into an RFQ.

Key idea in one sentence: plan for continuous flow (forecast + contracts + local logistics) and build redundancy into suppliers, storage, and financing.

Opening anecdote — the 48-hour outage that taught everyone a lesson

A district hospital in East Africa once ran out of HIV rapid test buffer because the single supplier’s container was stuck in customs for three weeks. The nurses improvised and postponed testing — which delayed linkage to care for dozens of patients. The hospital learned to (a) never rely on a single supplier, (b) budget for safety stock, and (c) negotiate vendor-managed inventory (VMI) or reagent-rental contracts where possible. Simple, brutal lessons — avoided with better procurement design.

The reality: why reagents & consumables are the fragile link

Diagnostics supply chains are fragile because the product mix is complex (kits, reagents, controls, swabs, pipette tips, cartridges), many inputs are import-dependent, shelf-lives are limited, and procurement timelines are long. Donors and ministries increasingly favour quality-assured products — which narrows supplier options and can mean longer lead times. You need both procurement smarts and operational muscle. Key frameworks and procurement guidance exist from WHO, FIND, UNICEF and the Global Fund — use them. Iris+2finddx.org+2

The core supply-chain toolbox (short)

-

Accurate forecasting & consumption data

-

Multiple qualified suppliers + local distributors

-

Contracts that fit the product (reagent rental, VMI, framework agreements)

-

Cold chain & storage SOPs (including temperature mapping)

-

Customs & regulatory readiness (documents, tax/exemption rules)

-

Quality checks on receipt & lot tracking (batch records, EQA)

-

Contingency & buffer stock financing

Each of these is unpacked below.

1) Forecasting: the place most projects fail — do this first

Good forecasting means you estimate monthly consumption by test type, by site, and by season (flu/malaria peaks). Use 6–12 months of historical consumption if available; if you’re a startup, model patient volumes under several scenarios (low/medium/high uptake). Key practical tips:

-

Use a simple three-column forecasting workbook: test type → avg monthly usage → safety stock days.

-

Safety stock = lead time (days) × average daily usage + buffer for demand surges (usually 30–90 days depending on product criticality).

-

Account for lot expiry: don’t accept consignments with short remaining shelf life unless price/circumstances justify it.

-

Review forecasts monthly and reconcile with consumption data.

WHO and FIND provide diagnostics procurement guidance and tools to structure forecasts for national programs — refer to those templates for standard formats. Iris+1

2) Supplier strategy: multiple qualified sources + local partners

Never buy your most critical reagent from a single unknown supplier.

Checklist to qualify suppliers:

-

Regulatory standing (CE/IVDD, WHO PQ where relevant, or recognized SRA).

-

References (other African ministries, UN agencies, big labs).

-

Local distributor or agent for spare parts and warranty.

-

Minimum order quantity (MOQs), lead times, incoterms (DAP, CIF, EXW).

-

Price transparency, sample policy, and access to COA (certificate of analysis) or batch QC data.

Use the Africa Medical Supplies Platform (AMSP) where appropriate for vetted suppliers and pooled buying; it can shorten procurement cycles and provide more favourable terms for member states. Also consider reputable UN/UNICEF supplier lists for quality-assured IVDs. amsp.africa+1

3) Contracts & procurement modalities — match the model to the reagent

-

Spot purchase (PO): useful for small orders; high admin overhead and risk of stockouts.

-

Framework agreements / annual contracts: lock price & supply windows for 6–12 months — recommend for core consumables.

-

Reagent-rental / all-inclusive per test: supplier provides instrument + reagents; buyer pays per test. Great for reducing upfront CAPEX and ensuring supply continuity. Global programs often prefer reagent rental models for molecular platforms. USAID Global Health Supply Chain Program

-

Vendor-Managed Inventory (VMI): supplier manages stock levels at your site and replenishes automatically — reduces local stockouts and admin burden but needs trust and good SLAs. USAID & GHSC programs promote VMI for diagnostics reagents. ASLM

-

Pooled procurement (AMSP, pooled tenders): reduces price and improves access for smaller buyers; good for smaller countries or counties.

Include Service Level Agreements (SLAs) with clear KPIs: fill rate, lead time, maximum tolerable stockout days, lot replacement timelines for defective product, and penalties for late delivery. Insist on COAs and batch tracking.

4) Cold chain & storage — don’t let boxes die on the shelf

Many reagents and controls require strict temperature ranges. Practical steps:

-

Temperature-map your storage rooms and cold rooms before purchasing (identify hot spots).

-

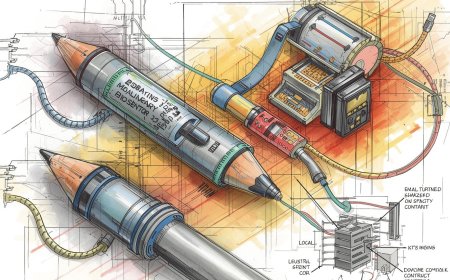

Use data loggers (cheap USB loggers or IoT sensors) during initial shipments to verify cold chain integrity.

-

SOP: accept delivery only with temperature logs for cold-chain items; quarantine and notify supplier on excursions.

-

Maintain a central inventory of temperature-sensitive items with expiry alerts and first-expire-first-out (FEFO) picking.

-

Consider small solar fridges / UPS for clinics with unreliable power. WHO and UNICEF provide technical requirements and guidance for cold chain and storage. UNICEF+1

5) Customs, import docs & regulatory readiness — avoid the “stuck in port” drama

Delays at customs kill lead time. Protect yourself:

-

Pre-clearance paperwork: commercial invoice, packing list, COA, product registration if required (local regulator), license to import IVDs.

-

Understand duty & tax exemptions for public health procurements in your country; some donor-funded consignments are exempt but paperwork differs.

-

Work with customs brokers who have experience with medical imports — cheaper to pay a broker fee than to have 6 weeks stuck inventory.

-

Consider using AMSP or UN agencies as the importing entity if their frameworks accelerate clearance. amsp.africa+1

6) Quality on receipt & lot tracking — don’t take a supplier’s word

Always run these checks on receipt:

-

Inspect packaging, lot numbers, expiry dates and storage temperature evidence.

-

Open and test a sample QC panel (positive/negative controls) for new lots before they’re released to testing lines.

-

Log batch/lot numbers against patient runs in your LIMS/Excel to enable tracebacks and recalls.

-

Join an EQA (external quality assessment) program for regular proficiency testing.

Document receipt checks and maintain a lot-tracking register — buyers and donors will ask for it.

7) Inventory systems & replenishment rules — simple automation helps

You don’t need an ERP on Day 1, but you do need discipline:

-

Basic tools: an Excel or Google Sheet consumption register, reorder level formula (ROP = lead time × average daily use + safety stock), automatic alerts.

-

If scale >10 sites, use a light LMIS/LIMS or open tools recommended by GHSC/Global Fund (PQR, PSM tools).

-

Automate email/SMS alerts for low stock, expiry notifications at 90/60/30 days before expiry.

-

Run monthly stock reconciliations and quarterly physical inventory counts.

Vendor dashboards (used in VMI or reagent rental models) should sync site-level usage so suppliers can forecast and replenish accurately.

8) Financing & working capital — plan for the burn

Reagents consume working capital. Consider:

-

Negotiating 30–90 day payment terms with suppliers, or staged payments (deposit + shipment + acceptance).

-

Revolving procurement funds at county or program level.

-

Donor bridge funding for stockpiles in pandemic contexts.

-

Reagent-rental or VMI to shift CAPEX and reduce upfront stock purchases.

The Global Fund, UNICEF and other partners provide procurement funding routes and technical guidance for budgeting reagent supply. The Global Fund+1

9) Local manufacture & regional sourcing — pros, cons and how to use them

Local manufacturing (or regional suppliers) shortens lead times and creates more reliable last-mile logistics, but local inputs (membranes, reagents) may still be imported. Use local manufacturers when they meet quality standards and can provide guaranteed lot supply; otherwise combine local supply for rapid needs with international backstops for scale. Africa CDC and WHO regional initiatives encourage local production and pooled procurement like AMSP to strengthen resilience. WHO | Regional Office for Africa+1

10) Contingency planning & risk register (sample risks + mitigations)

-

Risk: single-supplier failure → Mitigation: dual sourcing + VMI.

-

Risk: customs delays → Mitigation: hire experienced broker; pre-clearance docs.

-

Risk: temperature excursions → Mitigation: data loggers, quarantine SOPs, supplier replacement clause.

-

Risk: expiry of large stock → Mitigation: staggered deliveries, FEFO, redistribution to high-use sites.

-

Risk: currency shocks → Mitigation: price adjust clauses, local currency contracts.

Keep a short Risk & Mitigation table and review monthly.

Sample RFQ / Purchase Terms (copy-paste & adapt)

Include these clauses in every RFQ/PO for reagents/consumables:

-

Product details: manufacturer, catalogue no., lot no., pack size, expiry at least X months on receipt.

-

Quality: attach COA, CE/IVDD/WHO-PQ evidence or equivalent.

-

Delivery: incoterm (DAP to [warehouse address]), expected lead time (days), partial shipments allowed (Y/N).

-

Cold chain: state required temperature range and requirement for temperature loggers for shipments.

-

Warranty & replacement: supplier must replace any defective lots within 10 working days at no extra cost.

-

Lot tracking & documentation: supplier to provide COA, MSDS, packing list and serial/lot numbers for each package.

-

Payment: 30/60/90 day terms; retain 10% until acceptance testing passed (optional).

-

SLA & penalties: fill-rate ≥ 95%, penalty X% for late delivery beyond agreed lead time.

-

Customs support: supplier/origin agent shall provide full export docs and coordinate with importer to expedite clearance.

-

Confidentiality & IP: as required.

Quick operational checklist — paste into your SOPs

-

Forecast & safety stock calculated monthly.

-

At least two qualified suppliers for each critical reagent.

-

Contract modality chosen (framework / VMI / reagent rental) and SLA signed.

-

Cold chain mapping & data logger policy in place.

-

Customs broker identified; import checklist ready.

-

Receipt QC & lot tracking SOP active.

-

Monthly reconciliation & expiry review scheduled.

-

Contingency plan & risk register reviewed.

Short case references & programs to know (live links)

-

WHO Diagnostics Manual & procurement guidance — practical steps on procurement & QA for diagnostics. Iris

-

FIND Diagnostic Network Optimization (DNO) guide — planning networks, forecasting and procurement for diagnostic systems. finddx.org

-

UNICEF technical requirements for IVDs and procurement resources — standards expected by a major UN buyer. UNICEF

-

Africa Medical Supplies Platform (AMSP) — pooled procurement marketplace to access vetted suppliers and streamline orders. amsp.africa

-

Global Fund procurement & PSM guidance — policies and expectations when using Global Fund grants for reagent procurement. The Global Fund

-

Vendor-Managed Inventory (VMI) guidance & pilot materials (USAID/GHSC & ASLM presentations) — practical model for handing inventory management to suppliers. ASLM

Final practical advice — what to do this week

-

Run a 1-page forecast for your top 10 SKUs (tests, reagents, controls).

-

Identify whether each SKU has one or more qualified suppliers; if only one, start sourcing a second.

-

Create a one-page import checklist (docs & brokers) and add it to every PO.

-

Pilot a VMI or reagent-rental conversation with your top supplier — ask them for an SLA sample.

-

Start a basic lot-tracking spreadsheet and log the last 6 months of consumption.

Do these five things and you’ll dramatically reduce the “panic reorder” calls.

References (APA format — live links)

World Health Organization. (2019). Diagnostics manual: Procurement and supply of in vitro diagnostics. https://iris.who.int/bitstream/handle/10665/255568/9789241548663-eng.pdf?isAllowed=y&sequence=1. Iris

FIND. (2022). Guide to Diagnostic Network Optimization. https://www.finddx.org/wp-content/uploads/2022/12/20220909_guide_to_DNO_FV_EN.pdf. finddx.org

UNICEF Supply Division. (2021). Technical provisions for in-vitro diagnostics (IVD). https://www.unicef.org/supply/media/20106/file/TechnicalProvisionsForIn-vitroDiagnostics.pdf. UNICEF

Africa Medical Supplies Platform. (n.d.). AMSP — your one-stop shop for vetted medical supplies. https://amsp.africa/. amsp.africa

The Global Fund. (2021). Guide to Global Fund policies on procurement and supply management of health products. https://www.theglobalfund.org/media/5873/psm_procurementsupplymanagement_guidelines_en.pdf. The Global Fund

ASLM / USAID GHSC. (2024). Vendor-managed inventory (VMI) presentation and guidance. https://aslm.org/wp-content/uploads/2025/02/1733744509-resource_file-VMI-Presentation-ASLM_vShare_11182024.pdf. ASLM

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0