What HealthTech VCs Look for in African Startups: A Founder’s Guide

A practical, witty, and insight-packed guide revealing what venture capital (VC) investors really look for in African healthtech startups. Learn how to attract funding, structure your pitch, and avoid classic founder blunders — with African case studies, real investor insights, and APA-formatted citations with live URLs.

“When a VC says your startup has ‘great potential,’ they might mean you’re six PowerPoints and one cofounder away from a real business.”

HealthTech in Africa has exploded over the past five years. From telemedicine platforms in Kenya to diagnostics startups in Nigeria and AI-driven logistics in South Africa, investors are circling. But here’s the thing: getting VC funding in African healthtech isn’t just about having a “cool idea.”

It’s about proving you can survive the wild mix of unreliable power, policy surprises, and cash-light customers — and still make money while saving lives.

This guide breaks down what investors actually want to see, the mistakes that scare them off, and how to build a fundable healthtech company on the continent — with African examples, humorous field notes, and live, credible sources.

The African HealthTech Gold Rush — With a Twist

In 2024, Africa’s healthtech ecosystem attracted over $200 million in venture funding, marking a steady recovery after the global VC slowdown (Disrupt Africa, 2024). But while fintech still takes the lion’s share, healthtech is quietly earning respect for solving real problems: medicine access, diagnostics, data infrastructure, and workforce shortages.

Yet, investors are cautious. They’ve seen startups with flashy pilots but no unit economics. As one Nairobi-based VC quipped:

“Don’t tell me your app will ‘save Africa’ — tell me how you’ll pay your data bill next quarter.”

1. The Three Truths Every HealthTech Founder Must Know

💡 Truth #1: VC funding follows traction, not theory

VCs want evidence — not essays. Early pilots, user retention, and paying customers speak louder than “Total Addressable Market” charts. Even grants or NGO partnerships count as traction if they prove the solution works at scale.

💰 Truth #2: Healthtech is harder to scale than fintech

Fintechs deal with regulations; healthtechs deal with lives. Regulatory approvals, privacy laws, and fragmented public health systems slow growth. A fundable founder shows they understand the regulatory path and budget time for it.

🩺 Truth #3: Local context beats global copy-paste

An African healthtech startup must adapt to local constraints — poor internet, low literacy, cash economies, or public-sector inertia. “Uber for Doctors” may sound catchy, but it won’t fly in rural Uganda without offline workflows and mobile money integration.

2. What HealthTech VCs Actually Look For

a. A real problem, not a Silicon Valley fantasy

VCs back solutions that address urgent, monetizable pain points. For example:

-

Drug stock-outs in clinics (e.g., mPharma, Ghana)

-

Affordable diagnostics (e.g., 54Gene, Nigeria)

-

Rural telemedicine (e.g., Rocket Health, Uganda)

Show measurable improvement — reduced waiting times, better outcomes, or cheaper service delivery.

b. Strong unit economics — even if early

No investor believes “we’ll monetize later.” Show cost-per-patient, gross margins, or subsidy sustainability. Demonstrate a path to profitability, even if you’re still pre-revenue.

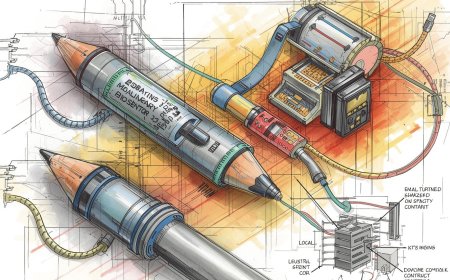

c. Scalable tech stack

Investors favor interoperable, modular systems that can integrate with DHIS2, open APIs, or regional health data networks. A single-country app with hard-coded logic screams “scaling nightmare.”

d. Regulatory awareness

Know your Ministry of Health’s licensing rules, data protection laws (Kenya Data Protection Act, South Africa POPIA), and WHO’s digital health guidelines (WHO, 2024). Nothing scares investors more than a “health startup” with no compliance plan.

e. Balanced team

A dream team blends medical expertise, tech skills, and business acumen. A healthtech startup with three coders and zero clinicians is a red flag.

3. The “Investor Smile Curve” — How to Impress in a Pitch

Imagine this: You’re pitching at a VC event in Nairobi.

-

Slide 1: Problem — half the audience nods.

-

Slide 2: Solution — polite silence.

-

Slide 3: Traction — smiles widen.

-

Slide 4: Financials — one investor stops scrolling LinkedIn.

-

Slide 5: Team slide — another scribbles your name.

Investors don’t back startups; they back founders who execute. Numbers — not buzzwords — create smiles.

4. Common Founder Mistakes (a.k.a. “How to Scare Off a VC in 30 Seconds”)

❌ Mistake 1: Overpromising “Africa-wide” reach before local traction

Start with one city or region. Investors love focus more than fantasy.

❌ Mistake 2: Ignoring compliance

Claiming “we’re just a wellness app” while collecting patient data is a legal time bomb.

❌ Mistake 3: Misunderstanding capital stages

Early-stage VCs aren’t here to fund R&D forever. Know when to switch from grants (PATH, Grand Challenges, USAID) to growth capital.

❌ Mistake 4: No clear exit plan

Healthtech investors eventually need ROI — acquisitions by larger health companies, or expansion-driven exits. Have a roadmap.

5. African Case Studies

🧬 Case 1: 54Gene (Nigeria)

Started as a genomic data startup addressing African underrepresentation in global health research. Within two years, it raised over $45 million from investors like Adjuvant Capital and Novartis Venture Fund (TechCrunch, 2023).

Lesson: Deep science + clear global relevance = investor magnet.

💊 Case 2: mPharma (Ghana)

Solved a local pain — expensive, inconsistent drug supply — with a network model. By proving reliability in Ghana before scaling, mPharma attracted funding from CDC Group and Goldman Sachs (Disrupt Africa, 2024).

Lesson: Local traction precedes expansion.

🏥 Case 3: Helium Health (Nigeria)

Built an electronic medical record system for African hospitals — boring but essential. They integrated billing and analytics, becoming a “digital infrastructure layer.” Raised over $42 million (Crunchbase, 2024).

Lesson: Boring problems often build billion-dollar value.

6. How to Win Investor Trust

a. Show data integrity

Health data is gold — but mishandled, it’s kryptonite. Prove your system encrypts patient data and meets GDPR or local equivalents.

b. Build partnerships early

Strategic alliances with hospitals, NGOs, or governments de-risk your model. VCs see partnerships as “barriers to entry” for competitors.

c. Demonstrate resilience

African founders face power outages, political shifts, and limited capital — yet still deliver. Resilience and adaptability signal execution strength.

7. Funding Landscape: Who’s Investing in African HealthTech

| Investor | Focus | Website |

|---|---|---|

| Adjuvant Capital | Global health & diagnostics | https://adjuvantcapital.com |

| Novastar Ventures | East & West Africa early-stage impact ventures | https://novastarventures.com |

| TLcom Capital | Pan-African tech with health verticals | https://tlcomcapital.com |

| EchoVC | Seed-stage African startups | https://www.echovc.com |

| VestedWorld | Emerging market growth companies | https://www.vestedworld.com |

| Founders Factory Africa | Venture studio for healthtech & fintech | https://foundersfactory.africa |

| Villgro Africa | Incubator for health and life sciences | https://villgroafrica.org |

These funds often co-invest with development financiers (IFC, USAID, BII) or regional accelerators (Co-Creation Hub, Injini, HealthTech Hub Africa).

8. The African Founder’s Edge

African founders are solving problems that the rest of the world can only theorize about: affordable diagnostics, offline health data, and community-based care delivery.

If your solution works in a Kenyan village clinic, it’s already more robust than half the “global health” prototypes in Geneva.

As one Tanzanian founder joked after closing a $1M seed round:

“I didn’t build for Silicon Valley — I built for when the power goes off mid-surgery.”

That’s the African founder advantage — grit meets ingenuity.

9. A Simple VC Readiness Checklist

✅ Have you proven real demand (users, revenue, or pilots)?

✅ Are your unit economics improving (not perfect, but positive trend)?

✅ Do you understand regulatory hurdles and have expert advisors?

✅ Can your product scale regionally with minimal rework?

✅ Is your founding team balanced (tech, health, and business)?

If you checked four or more, you’re VC-conversation ready.

10. Conclusion: Fund Vision, Not Vanity

The best healthtech startups don’t sell dreams; they sell execution. They blend social impact with sustainable economics and local understanding with global scalability.

In other words: build something real, make it work in one tough market, and investors will find you.

References (APA Format with Live URLs)

Disrupt Africa. (2024). African Tech Startups Funding Report 2024. https://disrupt-africa.com/reports/

Crunchbase. (2024). Helium Health funding overview. https://www.crunchbase.com/organization/helium-health

TechCrunch. (2023). 54Gene raises $45 million to advance African genomics. https://techcrunch.com/2023/05/17/54gene-series-b-funding/

World Health Organization (WHO). (2024). Global strategy on digital health 2020–2025: Regional implementation progress. https://www.who.int/publications/i/item/global-strategy-on-digital-health-2020-2025

Villgro Africa. (2024). Investing in African health innovation. https://villgroafrica.org/

PATH. (2024). African health innovation investment landscape. https://path.org/resources/african-health-innovation-investment-landscape/

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0