From Idea to Product-Market Fit: 12 Key Questions Startups Should Ask

This report provides a strategic roadmap for African healthtech founders, detailing 12 critical questions to navigate the "Valley of Death" and achieve product-market fit. It analyzes the ecosystem's shift from "vitamin" apps to essential "painkiller" infrastructure , emphasizing the necessity of offline-first architectures for low-connectivity regions. Key insights include strategies for overcoming regulatory fragmentation across the "Big Four" markets , designing business models for out-of-pocket payers , and leveraging "phygital" approaches that empower community health workers.

Executive Summary

The trajectory of the African healthtech sector has reached a critical inflection point. Following the global venture capital contraction of 2023 and 2024, the ecosystem is shifting from a period of exuberant experimentation to one of rigorous consolidation and fundamental value validation. While the narrative of "leapfrogging" legacy infrastructure remains compelling, the operational reality for startups on the ground has evolved. The market is no longer rewarding purely digital, asset-light solutions that mimic Silicon Valley models; instead, capital and growth are accruing to "full-stack" innovators who are willing to build the physical and digital rails required to operate in fragmented, low-trust, and infrastructure-poor environments.1

As of early 2025, the sector is characterized by a "survival of the fittest" dynamic. Funding patterns indicate a stabilization, yet a distinct tightening of due diligence standards, where investors are prioritizing unit economics and path-to-profitability over vanity metrics like user acquisition or gross merchandise value (GMV).2 The ecosystem has seen a surge in Mergers and Acquisitions (M&A), particularly in Egypt, Kenya, and Nigeria, as growth-stage companies acquire smaller entities to consolidate market share and integrate complementary product verticals—a trend driven by the necessity to achieve economies of scale in markets with thin consumer wallets.1

For the aspiring founder or the scaling executive, the path to Product-Market Fit (PMF) in this landscape is fraught with unique perils. The "Valley of Death"—the gap between initial grant funding and sustainable commercial revenue—is deeper and wider in Africa due to structural barriers such as regulatory heterogeneity, the dominance of out-of-pocket (OOP) payments, and the high cost of trust-building.5 This report posits that successful navigation of this landscape requires a fundamental recalibration of the startup playbook. We present twelve existential questions—spanning market validation, technical architecture, business modeling, and scaling strategy—that serve as a litmus test for viability in the African context.

This analysis draws upon a synthesis of recent market intelligence, case studies of both unicorns and failures (such as the collapse of 54gene), and regulatory frameworks from the "Big Four" markets (Nigeria, Kenya, South Africa, and Egypt). It argues that the most successful African healthtechs are not merely software companies; they are infrastructure builders, supply chain orchestrators, and financial intermediaries.7

Part I: Market Validation and Problem Definition

The first phase of the startup lifecycle in African healthcare is not simply identifying a problem but validating that the problem is commercially solvable within the constraints of the local economy. The graveyard of African startups is filled with companies that solved "vitamin" problems—nice-to-have conveniences—rather than "painkiller" problems—existential crises in access or survival.

Question 1: Is the Problem a "Vitamin" or a "Painkiller" in a Fragmented Value Chain?

In mature markets, healthtech often focuses on efficiency: reducing wait times, optimizing billing codes, or enhancing patient convenience. In the African context, these value propositions are frequently insufficient to drive adoption or payment. The successful African healthtech startup typically addresses a fracture in the fundamental value chain: the unavailability of drugs, the lack of financing for treatment, or the absence of diagnostic equipment.

The "Broken Rails" Thesis

The defining characteristic of the African healthcare landscape is fragmentation. The supply chain is often broken, involving dozens of middlemen between the manufacturer and the patient, which inflates prices by up to 50% and introduces a high prevalence of counterfeit medications.9 Startups that attempt to overlay a digital booking interface on top of this broken physical infrastructure often fail because the underlying service is unreliable.

mPharma’s Pivot to Infrastructure:

The trajectory of mPharma serves as a canonical case study in identifying a "painkiller" problem. Initially founded in 2013 as an electronic prescription network, the company quickly realized that a digital script was useless if the pharmacy did not have the drug in stock. The real pain point was not the prescription process but the supply chain fragmentation that left pharmacies understocked and patients without medication.7

mPharma pivoted to become a "Vendor-Managed Inventory" (VMI) provider. They took over the procurement and inventory risk for pharmacies, aggregating demand to negotiate lower prices with manufacturers. This was not a software play; it was a heavy operations and logistics play that solved the existential problem of drug availability.10 By 2025, successful startups are those that have followed a similar trajectory—moving from information exchange to value chain orchestration.

Market Segmentation: Painkillers vs. Vitamins

|

Sector |

"Vitamin" Approach (Low Viability) |

"Painkiller" Approach (High Viability) |

Leading Examples |

|

Pharmaceuticals |

Medication reminder apps; Price comparison tools |

Supply chain aggregation; Anti-counterfeit verification; Inventory financing |

mPharma, DrugStoc, Maisha Meds |

|

Diagnostics |

Consumer wellness trackers; Calorie counters |

Portable, low-cost diagnostic hardware; Asset financing for clinics |

Ilara Health, mScan, Butterfly Network |

|

Health Records |

Patient-controlled health vaults (PHR) |

Hospital Management Systems (HMS) linked to credit/financing facilities |

Helium Health, CarePay |

|

Logistics |

On-demand courier for supplements |

Cold-chain distribution for blood/vaccines; Autonomous drone networks |

Zipline, LifeBank |

The "painkiller" status is often linked to financial liquidity. Helium Health, for instance, found that digitizing hospital records (EMR) was useful, but the "killer feature" was using that data to extend credit to hospitals (HeliumCredit) that were otherwise locked out of the banking system.8 The startup solved a liquidity crisis, not just a data storage problem.

Question 2: Does the Solution Respect the "Digital Divide" and Cultural Reality?

A fatal error for many healthtech ventures is designing for the "Silicon Valley user"—one with a high-end smartphone, continuous 4G/5G data, and high digital literacy. The African reality is a continuum of connectivity and literacy that requires a multi-modal interface strategy.

The Connectivity Spectrum and Interface Design

While mobile internet penetration is rising—reaching approximately 28% in Nigeria and 33% in Kenya—a significant portion of the addressable market, particularly in rural areas, remains offline or dependent on feature phones.13 Furthermore, even smartphone users often turn off data to save money, rendering "always-online" apps useless.

USSD and SMS as Critical Infrastructure:

Despite the hype around AI and apps, Unstructured Supplementary Service Data (USSD) remains a dominant channel for critical services because it functions on basic GSM networks without internet data.

-

Case Evidence: Research indicates that in 2025, USSD is still vital for inclusivity, used extensively for mobile money and health information services.14

-

Hybrid Models: Successful platforms often use a tiered approach: a rich web/app interface for doctors and administrators in urban centers, and a USSD/SMS interface for patients in rural areas. For example, Babyl Rwanda and MomConnect in South Africa achieved massive scale not by demanding app downloads, but by meeting users on the platforms they already used (feature phones and WhatsApp).16

Cultural Trust and Language

The "human element" is non-negotiable. Digital health interventions often face resistance due to a lack of trust in automated systems, especially when they disrupt traditional hierarchies of care.

-

Language Barriers: A study of digital health adoption revealed that apps failing to support local languages suffer high churn. In South Africa, where clinical encounters often bridge 12 official languages, the inability of an app to communicate in Zulu or Xhosa can be a clinical risk.18 Chatbots like Likita are leveraging Natural Language Processing (NLP) to bridge this gap, but the technology is still maturing.20

-

The "In-Person" Preference: Patients in many African markets prefer face-to-face interactions, equating physical presence with quality of care. Pure telemedicine models have struggled to retain users compared to "phygital" (physical + digital) models. Zuri Health and Ilara Health empower existing physical clinics rather than trying to replace them, leveraging the trust patients already have in their local pharmacist or nurse.21

Question 3: Is the Regulatory Strategy Viable Across Borders?

The African regulatory landscape is not a monolith; it is a patchwork of 54 distinct legal frameworks, ranging from the highly sophisticated to the non-existent. A strategy that works in Nairobi may be illegal in Lagos.

Navigating Regulatory Maturity Zones

Startups must categorize their target markets by regulatory maturity to assess compliance costs and risks:

-

Zone 1: Mature/Strict (South Africa): South Africa’s regulatory environment is comparable to Europe’s. The Protection of Personal Information Act (POPIA) mandates strict data privacy protocols, breach notifications, and data sovereignty.24 Compliance here is expensive but clear.

-

Zone 2: Evolving (Kenya, Nigeria, Rwanda): These markets are rapidly modernizing. Nigeria’s Data Protection Regulation (NDPR) and Kenya’s Data Protection Act (2019) create frameworks for digital health, but enforcement can be inconsistent.13 The Digital Health Act 2023 in Kenya has provided more clarity, but startups often operate in a "gray zone" while secondary legislation is drafted.13

-

Zone 3: Nascent/Undefined: In many other markets, specific e-health laws do not exist. While this allows for rapid initial deployment, it carries the risk of sudden, arbitrary regulatory crackdowns or policy shifts that can destroy a business model overnight.5

The Cross-Border Licensing Trap

Telemedicine and digital pathology startups face significant hurdles in cross-border scaling. Medical licenses are typically national. A radiologist in Cairo cannot legally diagnose a patient in Kampala without local registration.

-

Operational Workarounds: To circumvent this, companies like Helium Health and Zuri Health often adopt a "local-first" expansion strategy: they establish local legal entities and recruit locally licensed practitioners in each new market, rather than attempting to service the continent from a single hub.23

-

Data Sovereignty: Data localization laws are becoming stricter. Nigeria and other nations increasingly require health data to be stored on servers physically located within the country.23 This forces startups to adopt distributed cloud architectures or partner with local data centers (e.g., MainOne, MDXi) rather than relying on a single AWS region in Cape Town or Europe.

Case Study: The 54gene Regulatory Complexity

The collapse of 54gene serves as a stark warning regarding the complexity of regulatory and bio-ethical landscapes. While the company aimed to monetize African genomic data, it faced significant headwinds related to genomic data sovereignty, bioethics compliance across multiple jurisdictions, and the lack of clear regulatory frameworks for exporting biological samples. These delays and compliance costs contributed to a burn rate that became unsustainable.30

Part II: Solution Design and Technical Architecture

Once the market problem is validated and the regulatory landscape mapped, the startup must build a solution that can survive the physical realities of the continent. The "copy-paste" approach of deploying cloud-native apps designed for high-bandwidth environments is a recipe for failure.

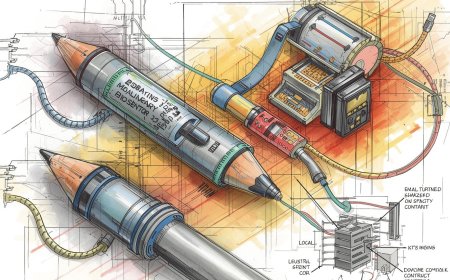

Question 4: Is the Technology Stack "Offline-First" and Resilient?

In many African markets, "downtime" is not an edge case; it is a daily operational reality. Power grids are unstable, and internet connectivity is intermittent. A healthtech product that stops working when the internet cuts out is a product that puts lives at risk.

The "Offline-First" Mandate

Successful African healthtech software is built on "offline-first" architecture. This means the application logic and database reside locally on the device (tablet, smartphone, or server), allowing full functionality without an internet connection. Data synchronization occurs in the background only when connectivity is restored.

-

Technical Implementation: This requires robust conflict-resolution algorithms to handle data discrepancies when multiple offline devices sync back to the central server.

-

Case Evidence: Hikma Health’s deployment of Electronic Health Records (EHRs) in refugee settings demonstrated that offline capability was the single most critical technical feature for adoption.32 Similarly, Uganda’s AI-driven supply chain system was explicitly architected to be "offline-capable" to ensure that remote clinics could continue to manage stock and dispense drugs during internet blackouts.33

-

Failure Mode: Startups that rely on heavy, browser-based web apps often see high churn in rural clinics because page load times are too slow or the system hangs during critical patient encounters.34

Hardware Robustness

Beyond software, hardware must be adapted for the environment. Standard medical equipment often fails due to heat, dust, and humidity.

-

mScan (Uganda): This startup developed a portable ultrasound device specifically designed for low-resource settings. Unlike traditional ultrasound machines that require constant grid power, mScan’s device is energy-efficient, portable, and interfaces with standard laptops or tablets, making it viable for rural antenatal care.36

-

Frugal Engineering: The "graveyard of donated equipment"—where expensive western medical devices sit unused in African hospitals due to lack of parts or power—illustrates the need for equipment designed for local maintainability and environmental resilience.38

Question 5: How Do We Engineer Trust in a Low-Trust Environment?

Trust is the most scarce commodity in African healthcare. The market is plagued by counterfeit drugs (estimated at 10-70% prevalence depending on the region), unlicensed "quack" doctors, and fraudulent clinics.10

Verification as a Core Product Feature

Digital platforms must do more than connect users; they must verify the participants.

-

Provider Credentialing: Telemedicine platforms like Zuri Health implement rigorous, multi-step verification processes for doctors, checking against national medical council databases and conducting background checks. This "verified" status becomes the primary value proposition to the patient.23

-

Supply Chain Transparency: Startups like DrugStoc and RxAll use technology (blockchain, AI spectrometers) to guarantee the authenticity of pharmaceutical products. For a pharmacy, buying from DrugStoc is not just about convenience; it is an insurance policy against the reputational risk of selling fake drugs.10

The Role of Community Health Workers (CHWs)

In many communities, the Community Health Worker (CHW) is the only trusted source of medical advice. Successful startups do not try to bypass the CHW; they empower them.

-

The "Augmented Human" Model: Startups are building mobile tools specifically for CHWs to improve their diagnostic and referral capabilities. Research from Malawi and Kenya shows that equipping CHWs with smartphone-based decision support tools (mHealth) significantly increases the uptake of antenatal care and facility-based births.40 The technology gains trust by "borrowing" the credibility of the human CHW.

Question 6: Is the Innovation "Frugal" and Accessible?

"Frugal innovation" is not about making cheap, low-quality products. It is about high-tech engineering that strips away non-essential features to drastically reduce cost while maintaining clinical utility.

Asset Financing and Device Access

The upfront cost of medical equipment is a massive barrier for the thousands of small, private clinics that serve the majority of the population.

-

Ilara Health’s Model: Ilara Health creates a marketplace for portable, affordable diagnostics (like the Butterfly iQ ultrasound). Crucially, they do not just sell the device; they offer it on a "lease-to-own" or revenue-share basis. This asset financing model aligns the cost with the clinic’s cash flow, unlocking a market that traditional device manufacturers ignore.21

-

Impact: By deploying over 1,000 Butterfly iQ+ probes in Kenya and South Africa, this model has enabled decentralized screening for maternal health conditions, catching complications early and reducing referrals to overcrowded hospitals.42

Part II: Business Model and Monetization Strategy

Solving the problem is only half the battle; getting paid is the other. The revenue models that work in the West—employer-sponsored insurance or government reimbursement—are limited in Africa.

Question 7: Who Pays? (Solving the Payer Problem)

The "Who pays?" question is the single most difficult challenge in African healthtech.

The Out-of-Pocket (OOP) Constraint

In Sub-Saharan Africa, OOP payments account for approximately 50% of total health expenditure.43 This creates a high friction for adoption. If a patient has to choose between food and a digital health subscription, they will choose food.

-

Micro-Payments: Startups are innovating with micro-payment models. mPharma’s "Mutti" program allows patients to pay for chronic medications in small installments (micro-payments), preventing treatment abandonment due to lack of lump-sum cash.11

-

Fintech Integration: The intersection of fintech and healthtech is critical. Helium Health and CarePay have integrated mobile wallets and "Save-to-Pay" features, allowing patients and relatives to save specifically for healthcare expenses.8

B2B and B2B2C Shifts

Given the shallow consumer wallet, many startups have pivoted to B2B models where the customer has better liquidity.

-

Selling to Providers: Helium Health monetizes by selling to hospitals (B2B). Hospitals have cash flow and a business incentive to reduce leakage and improve efficiency.

-

Selling to Corporates: Telemedicine startups often find their most reliable revenue stream in selling subscription packages to corporate employers who want to reduce absenteeism among their workforce.46

Question 8: Can Unit Economics Survive the "Infrastructure Tax"?

Operating in Africa incurs an "infrastructure tax"—the extra cost of providing your own power, security, and logistics.

The Logistics Cost Driver

Delivering physical goods (blood, oxygen, drugs) is expensive due to traffic congestion, poor road networks, and high fuel costs.

-

Multimodal Logistics: LifeBank (Nigeria) employs a hybrid fleet strategy—motorbikes for traffic-choked Lagos, boats for riverine areas, and drones for hard-to-reach locations—to optimize delivery speed and cost.47

-

Zipline’s Economics: Zipline operates autonomous drones for medical delivery. While highly effective for critical, high-value items like blood and vaccines, the unit economics are capital intensive. Zipline’s model relies on high-volume government contracts (often subsidized by donors or the US government) to cover the fixed costs of its distribution hubs.48 For routine low-value commodities, drone delivery economics are harder to justify without subsidy.

Avoiding the "Burn Rate" Trap

Investors are increasingly scrutinizing "vanity metrics" (e.g., number of downloads) and demanding "unit profitability."

-

The 54gene Warning: The rapid rise and fall of 54gene illustrates the danger of high fixed costs. The company invested heavily in state-of-the-art labs and high salaries for expatriate talent, creating a burn rate that outpaced its revenue from genomic data sales. When the funding climate cooled, the lack of sustainable unit economics led to its collapse.30

Question 9: Is the B2G (Business-to-Government) Pathway Navigable?

Governments are the largest healthcare providers in Africa, but selling to them is notoriously difficult.

The B2G Sales Cycle

Sales cycles to African governments can take 18-24 months and are often opaque.

-

Payment Risks: Governments are frequently slow payers. A startup relying on government contracts can face fatal liquidity crises if invoices remain unpaid for months.

-

Public-Private Partnerships (PPPs): Successful B2G strategies often utilize PPP structures, frequently backed by third-party donors or development finance institutions (DFIs) to de-risk payment. Zipline’s expansion into Ghana and Rwanda was facilitated by government contracts that were structurally supported by partners like the Gates Foundation and Gavi.49

-

Managed Equipment Services (MES): Companies like Philips and GE have successfully used MES models, where they equip government hospitals and charge a service fee based on usage rather than a capital sale. This aligns with government budgets which often prefer operational expenditure (OpEx) over massive capital expenditure (CapEx).51

Part IV: Scaling, Funding, and Sustainability

Question 10: How Do We Bridge the "Valley of Death" in Funding?

There is a significant gap between early-stage grant funding and commercial Venture Capital (VC). This "Valley of Death" claims many startups that cannot transition from "impact project" to "investable business."

The Grant-to-Commercial Transition

Many African healthtechs begin with grant funding (e.g., from the Bill & Melinda Gates Foundation, USAID, or Grand Challenges). mScan utilized grants to prototype its ultrasound device.42

-

The Trap: Relying on grants can create a "project mentality" focused on donor reporting rather than a "product mentality" focused on customer revenue.

-

The VC Pivot: To raise Series A or B funding (like Helium Health’s $30M round), founders must demonstrate commercial traction metrics: Annual Recurring Revenue (ARR), low churn, and Customer Lifetime Value (LTV).12 VCs in 2024/2025 are asking tough questions about "indigenous innovation" vs. "copy-paste" models and are deeply skeptical of models that cannot survive a currency devaluation.52

VC Due Diligence Checklist (2025):

-

Currency Risk: How does the startup hedge against the depreciation of the Naira or Cedi?

-

Unit Economics: Is the CAC payback period under 12 months?

-

Regulatory MOAT: Does the startup have exclusive licenses or verified data that competitors cannot easily replicate?.53

Question 11: Is the Model Adaptable to Pan-African Heterogeneity?

Africa is 54 markets, not one. Scaling from Nigeria to Kenya is operationally distinct from scaling from Texas to California.

The "Big Four" Expansion Strategy

Most scaling startups focus on the "Big Four" tech ecosystems: Nigeria, Kenya, South Africa, and Egypt.13

-

Nigeria: High volume (230M people), chaotic infrastructure, high regulatory volatility, aggressive competition.

-

Kenya: "Silicon Savannah," mature mobile money (M-Pesa), higher digital literacy, clearer e-health regulations, serving as a hub for East Africa.56

-

South Africa: High regulatory bar (POPIA), sophisticated private insurance market, high inequality between public and private sectors.

-

Egypt: Gateway to MENA, high physician density, distinct language (Arabic) and cultural norms.

Inorganic Growth (M&A)

Scaling organically is slow due to the need to obtain new licenses in every country.

-

Buy-and-Build Strategy: mPharma expanded into Kenya not by starting from zero, but by acquiring the Haltons pharmacy chain. This instantly provided them with a physical footprint, licenses, and a customer base.10 Similarly, Helium Health acquired Meddy (a doctor booking platform) to enter the GCC/Qatar market, leveraging acquisition for regional expansion.1 Consolidation is becoming the primary mechanism for pan-African scale.3

Question 12: How Do We Measure and Sell Impact?

For African healthtech, "Impact" is a strategic asset. It unlocks "blended finance"—capital that accepts lower financial returns for higher social impact.

The "Double Bottom Line"

Startups must track two sets of KPIs:

-

Financial: Revenue, Gross Margin, Burn Rate.

-

Impact: Lives saved, stockout reduction, patient reach in underserved areas.

-

LifeBank explicitly tracks the number of pints of blood delivered and mothers saved, using these metrics to attract funding from impact-focused investors.47

-

DrugStoc tracks the reduction in counterfeit drugs in the supply chain.

Impact Metrics vs. Vanity Metrics:

|

Metric Type |

Vanity Metric (Avoid) |

Impact/North Star Metric (Track) |

|

User Growth |

Total App Downloads |

Active Daily/Monthly Users (DAU/MAU) 13 |

|

Financial |

Total GMV (Gross Merchandise Value) |

Net Revenue / Gross Margin |

|

Health |

Number of doctors on platform |

Patient outcomes (e.g., reduction in maternal mortality rate) |

|

Operational |

Number of countries active |

Unit Economics per delivery/consultation |

Conclusion: The Path Forward

The African healthtech ecosystem is maturing. The initial wave of "digital for digital's sake" is receding, replaced by a hardened generation of companies that are building the physical, financial, and digital infrastructure required to deliver care.

Strategic Synthesis for Founders:

-

Build Rails, Not Just Apps: If the infrastructure doesn't exist, you must build it or partner with someone who has.

-

Embrace Hybrid Models: The future is "Phygital." Combine the scalability of software with the trust of human intermediaries (CHWs, Pharmacists).

-

Financial Engineering is Healthcare Engineering: Solving the payer problem through credit, insurance, or asset financing is as important as clinical innovation.

-

Localize Ruthlessly: Respect the language, culture, and regulatory reality of each specific market.

The outlook for 2025 is one of "realistic optimism".44 The capital is available, but it is discerning. The startups that answer these twelve questions with rigor and honesty will be the ones that survive the "Valley of Death" and define the future of healthcare on the continent.

Summary of Key Insights

|

Pillar |

Core Question |

Strategic Implication |

|

Market |

1. Vitamin or Painkiller? |

Focus on broken supply chains and financing gaps. |

|

2. Contextual Fit? |

Prioritize offline-first, USSD, and local languages. |

|

|

3. Regulatory Strategy? |

Navigate fragmentation with local entities; prepare for data sovereignty. |

|

|

Product |

4. Tech Stack? |

Build for intermittency (offline sync, rugged hardware). |

|

5. Trust Engineering? |

Verify providers/products; empower CHWs. |

|

|

6. Frugal Innovation? |

Use asset financing to lower barriers to device adoption. |

|

|

Business |

7. Who Pays? |

Pivot to B2B/B2G or use micro-payments/BNPL. |

|

8. Unit Economics? |

Optimize logistics (multimodal); control burn rate. |

|

|

9. B2G Viability? |

Leverage PPPs and donor-backed contracts. |

|

|

Scale |

10. Funding Strategy? |

Bridge the grant-to-VC gap with clear commercial traction. |

|

11. Scalability? |

Use M&A to enter new markets ("Big Four"). |

|

|

12. Impact Metrics? |

Measure outcomes to unlock blended finance. |

Works cited

-

HOME-GROWN SOLUTIONS ACCELERATOR 20 24 - AMRH, accessed December 10, 2025, https://amrh.nepad.org/sites/default/files/resourcefiles/27.%2001.%202025%20HGS%20Accelerator%20Impact%20Report%202024.pdf

-

HealthTech Africa emerges in 2025 driven by significant investments and innovation, accessed December 10, 2025, https://www.healthcare.digital/single-post/healthtech-africa-emerges-in-2025-driven-by-significant-investments-and-innovation

-

State of African Tech in 2024: Key Trends and 2025 Outlook, accessed December 10, 2025, https://insights.techcabal.com/state-of-african-tech-in-2024-key-trends-and-2025-outlook/

-

Venture Capital in Africa Report - AVCA, accessed December 10, 2025, https://www.avca.africa/media/pk1lhhzc/avca_2024_venture_capital_in_africa_report_rel-31-march.pdf

-

From Obstacles to Opportunities: How Health Startups are Redefining Healthcare in Africa, accessed December 10, 2025, https://villgroafrica.org/from-obstacles-to-opportunities/

-

Catalyzing Innovative Health Financing in Africa - IQVIA, accessed December 10, 2025, https://www.iqvia.com/locations/middle-east-and-africa/blogs/2025/07/catalyzing-health-financing-in-africa

-

mPharma (A) - Case - Faculty & Research - Harvard Business School, accessed December 10, 2025, https://www.hbs.edu/faculty/Pages/item.aspx?num=59405

-

Helium Health Asset Profile - Preqin, accessed December 10, 2025, https://www.preqin.com/data/profile/asset/helium-health/374503

-

innovator look book 2025 - HealthTech Hub Africa, accessed December 10, 2025, https://thehealthtech.org/storage/2025/08/2025-LOOK-BOOK.pdf

-

Case Studies on Home-grown Digital Health Innovation in Africa, accessed December 10, 2025, https://digitalhealth-africa.org/case-studies-on-home-grown-digital-health-innovation-in-africa/

-

mPharma Business Model: Everything You Need To Know - Yelo, accessed December 10, 2025, https://jungleworks.com/mpharma-business-model/

-

Announcing Helium Health's $30M Series B, accessed December 10, 2025, https://heliumhealth.com/announcing-helium-healths-30m-series-b/

-

A Strategic Guide to Achieving Product-Market Fit for Digital Health Apps in Africa, accessed December 10, 2025, https://medstartups.org/a-strategic-guide-to-achieving-product-market-fit-for-digital-health-apps-in-africa

-

Impact of USSD on Healthcare and Education in Africa - hSenid Mobile, accessed December 10, 2025, https://hsenidmobile.com/impact-of-ussd-on-healthcare-and-education-in-africa/

-

What is USSD and Why It's Still Relevant in 2025 - Mobulk Africa, accessed December 10, 2025, https://mobulkafrica.pro/what-is-ussd-and-why-its-still-relevant-in-2025/

-

How Mobile Health Improves Telemedicine Access in Africa, accessed December 10, 2025, https://www.techinafrica.com/how-mobile-health-improves-telemedicine-access-in-africa/

-

AN OVERVIEW OF HEALTHCARE CHATBOTS IN AFRICA | by Digital Health Africa, accessed December 10, 2025, https://medium.com/@dhealthafrica/an-overview-of-healthcare-chatbots-in-africa-fb72a31f6297

-

Usability of technological tools to overcome language barriers in health care: a scoping review protocol - NIH, accessed December 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10928737/

-

Full article: Preferences for onward health data use in the electronic age among maternity patients and providers in South Africa: a qualitative study, accessed December 10, 2025, https://www.tandfonline.com/doi/full/10.1080/26410397.2023.2274667

-

Health Chatbots in Africa: Scoping Review - Journal of Medical Internet Research, accessed December 10, 2025, https://www.jmir.org/2023/1/e35573/

-

Innovator Spotlight: ilara Health - Villgro Africa, accessed December 10, 2025, https://villgroafrica.org/villgro-africa-innovator-spotlight-ilara-health/

-

Why We Invested in Ilara Health: Improving Access to Healthcare in Africa., accessed December 10, 2025, https://untapped-global.com/insights/why-we-invested-in-ilara-health

-

A Go-to-Market Blueprint for Telehealth Services in the African Market: A Strategic Framework for Entry, Growth, and Sustainable Impact - MedStartups, accessed December 10, 2025, https://medstartups.org/a-go-to-market-blueprint-for-telehealth-services-in-the-african-market-a-strategic-framework-for-entry-growth-and-sustainable-impact

-

Africa Data Security and Privacy Guide - Baker McKenzie, accessed December 10, 2025, https://www.bakermckenzie.com/-/media/files/insight/guides/2022/africa-data-privacy.pdf?sc_lang=en&hash=28FB5D9D701F5E4592625750A6F79A32

-

The Protection of Personal Information Act (POPIA): A Comprehensive Guide to South Africa's Data Privacy Regulation - Captain Compliance, accessed December 10, 2025, https://captaincompliance.com/education/the-protection-of-personal-information-act-popia-a-comprehensive-guide-to-south-africas-data-privacy-regulation/

-

Tech Regulation in Africa: Recently Enacted Data Protection Laws | Global Policy Watch, accessed December 10, 2025, https://www.globalpolicywatch.com/2021/12/tech-regulation-in-africa-recently-enacted-data-protection-laws/

-

Strengthening Medical Technology Innovation Ecosystems to address Non-Communicable Diseases in Least Developed Countries - Main challenges and enablers in the MedTech sector in LDCs - WIPO, accessed December 10, 2025, https://www.wipo.int/web-publications/strengthening-medical-technology-innovation-ecosystems-to-address-non-communicable-diseases-in-least-developed-countries/en/main-challenges-and-enablers-in-the-medtech-sector-in-ldcs.html

-

A Guide to Building a Telehealth Practice in Africa & Beyond, accessed December 10, 2025, https://drlevicheruocheptora.com/blog/details/a-guide-to-building-a-telehealth-practice-in-africa-amp-beyond/32

-

Telehealth around the world: a global guide - DLA Piper Intelligence, accessed December 10, 2025, https://www.dlapiperintelligence.com/telehealth/countries/handbook.pdf

-

What Happened to 54gene & Why Did It Fail? - Sunset, accessed December 10, 2025, https://www.sunsethq.com/blog/why-did-54gene-fail

-

New Nigerian Biobank Advances Africa's Genomic Revolution, accessed December 10, 2025, https://www.ifc.org/en/stories/2020/i14-54gene

-

A Free, Open-Source, Offline Digital Health System for Refugee Care - JMIR Medical Informatics, accessed December 10, 2025, https://medinform.jmir.org/2022/2/e33848/

-

Uganda Unveils Africa's First Offline-Capable AI Framework To Boost Health Supply Chains, accessed December 10, 2025, https://iafrica.com/uganda-unveils-africas-first-offline-capable-ai-framework-to-boost-health-supply-chains/

-

African digital health strategic plans analysis: key weaknesses in contextualization, intervention focus, and technological foresight - PubMed Central, accessed December 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12680716/

-

Digital Health Technology Infrastructure Challenges to Support Health Equity in the United States: Scoping Review - Journal of Medical Internet Research, accessed December 10, 2025, https://www.jmir.org/2025/1/e70856

-

M-Scan - Google for Startups, accessed December 10, 2025, https://startup.google.com/alumni/stories/m-scan/

-

mscan - MIT Solve, accessed December 10, 2025, https://solve.mit.edu/challenges/equitable-health-systems/solutions/58155

-

Utility of hand-held ultrasound for image acquisition and interpretation by trained Kenyan providers - PMC - NIH, accessed December 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9995612/

-

LEADING INNOVATIONS ENABLING HEALTH PRODUCT ACCESS IN AFRICA - Salient Advisory, accessed December 10, 2025, https://www.salientadvisory.com/wp-content/uploads/2024/07/2024-Market-Intelligence-Report-FINAL.pdf

-

Evaluating the Adoption of mHealth Technologies by Community Health Workers to Improve the Use of Maternal Health Services in Sub-Saharan Africa: Systematic Review, accessed December 10, 2025, https://mhealth.jmir.org/2024/1/e55819

-

Experiences of community health workers on adopting mHealth in rural Malawi: A qualitative study - PMC - NIH, accessed December 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11097726/

-

Butterfly deploys 1,000 POCUS probes to practitioners across Kenya and South Africa, accessed December 10, 2025, https://www.butterflynetwork.com/case-studies-1000-probes

-

Models of public–private engagement for health services delivery and financing in Southern Africa: a systematic review - Oxford Academic, accessed December 10, 2025, https://academic.oup.com/heapol/article/31/10/1515/2567069

-

The Business of Health in Africa - UNIDO, accessed December 10, 2025, https://www.unido.org/sites/default/files/2016-01/IFC_HealthinAfrica_Final_0.pdf

-

Annual Impact Report - mPharma, accessed December 10, 2025, https://mpharma.com/wp-content/uploads/2022/04/Impact-Report-_mPharma-2021.pdf

-

5 B2B Revenue Models Every Healthcare Startup Should Consider - Cure., accessed December 10, 2025, https://wewillcure.com/insights/entrepreneurship/care-delivery/5-b2b-revenue-models-every-healthcare-startup-should-consider

-

LIFEBANK - Inclusive Business, accessed December 10, 2025, https://www.inclusivebusiness.net/sites/default/files/2021-08/Factsheet%20LifeBank_Final_23.2.21.pdf

-

U.S. backs Zipline with $150M for drone delivery in Africa - The Robot Report, accessed December 10, 2025, https://www.therobotreport.com/us-backs-zipline-with-150m-for-drone-delivery-in-africa/

-

The US backs Zipline with $150M to expand drone deliveries in Africa - Techpoint Africa, accessed December 10, 2025, https://techpoint.africa/insight/techpoint-digest-1232/

-

“It's Not If They'll Come for You; It's When” — Founder of Collapsed Healthtech 54gene Digs in New Exposé - Launch Base Africa, accessed December 10, 2025, https://launchbaseafrica.com/2024/10/18/its-not-if-theyll-come-for-you-its-when-founder-of-collapsed-healthtech-54gene-digs-in-new-expose/

-

Nigeria: Assessed Challenges in Africa Represent Collaborative Opportunities, Says Dongen - allAfrica.com, accessed December 10, 2025, https://allafrica.com/stories/201410201505.html

-

What HealthTech VCs Look for in African Startups: A Founder's Guide - MedStartups, accessed December 10, 2025, https://medstartups.org/healthtech-vcs-african-startups-founders-guide

-

Iterating on the Due Diligence Process in Healthtech VC - Amitha Kalaichandran - Medium, accessed December 10, 2025, https://amithakalaichandran.medium.com/iterating-on-the-due-diligence-process-in-healthtech-vc-f233c5b11f86

-

18 Questions Every VC Should Ask a Founder During an Introductory Call - GoingVC, accessed December 10, 2025, https://www.goingvc.com/post/18-questions-every-vc-should-ask-a-founder-during-an-introductory-call

-

Mapping the regulatory landscape of AI in healthcare in Africa - PMC - PubMed Central, accessed December 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10484713/

-

Kenya - Digital Economy - International Trade Administration, accessed December 10, 2025, https://www.trade.gov/country-commercial-guides/kenya-digital-economy

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0