Bridging the Gap: How Africa Can Transform Groundbreaking Health Research Into Market-Ready Innovation

Africa is experiencing a surge of medical and healthcare innovation, yet many groundbreaking discoveries never reach patients due to gaps in funding, regulation, manufacturing, and commercialization. This article explores the continent’s research-to-market challenges, highlights real-world case studies such as Zipline’s medical drones, MomConnect, mPedigree, Moldiag’s mpox diagnostics, and Yemaachi Biotech, and outlines strategies that can strengthen Africa’s health innovation ecosystem for sustainable impact.

Abstract

Innovation is central to Africa’s development agenda, yet the pathway from groundbreaking health research to scalable, market-ready solutions remains fragmented and fragile. This paper synthesizes secondary literature to examine why the “valley of death” between discovery and deployment is so deep in African medical and healthcare innovation. It describes structural constraints such as underinvestment in research and development (R&D), fragmented regulatory systems, limited manufacturing capacity, weak technology transfer mechanisms, and risk-averse procurement. Case studies—including drone delivery of blood and medicines (Zipline), South Africa’s MomConnect maternal mHealth platform, Ghana-born mPedigree’s anti-counterfeit technologies, local diagnostic manufacturing (Moldiag’s mpox tests in Morocco), and genomics-driven cancer research (Yemaachi Biotech)—illustrate both the promise and the bottlenecks of African health innovation ecosystems. Continental initiatives such as Grand Challenges Africa and the emerging African Medicines Agency (AMA) are discussed as potential game changers. The paper concludes with recommendations for strengthening translational funding, regulatory harmonization, product-development partnerships, and demand-side incentives that can help convert more African health inventions into sustainable, impactful solutions.

Keywords: Africa, health innovation, commercialization, research translation, drone delivery, mHealth, regulation

1. Introduction

Africa faces a dual disease burden: persisting infectious illnesses such as HIV, tuberculosis, and malaria, alongside a rapid rise in non-communicable diseases (NCDs) like cancer, diabetes, and cardiovascular disease. Recent estimates suggest NCDs already account for over one-third of deaths in sub-Saharan Africa and could become the leading cause of mortality by 2030. The Guardian At the same time, the continent’s young population, expanding digital infrastructure, and growing innovation ecosystems have generated a surge of health-related research and entrepreneurial activity.

Despite this momentum, the translation of research into market-ready health products and services remains limited. African countries spend on average only about 0.45% of GDP on R&D, well below the global average of 1.7%, constraining the innovation pipeline and its downstream commercialization. World Economic Forum+1 Even when promising technologies are developed, they frequently stall before reaching patients, trapped in what is often termed the “valley of death” between proof-of-concept and sustainable scale.

This paper uses secondary research to explore why this gap persists in African medical and healthcare innovation and how it might be bridged. It focuses on five guiding questions:

-

What characterizes Africa’s current health innovation landscape?

-

Which structural barriers most strongly impede translation from research to market?

-

What do real-world case studies reveal about success factors and failure points?

-

How are continental and regional initiatives attempting to reshape the ecosystem?

-

What practical strategies could close the gap in the coming decade?

2. Africa’s Health Innovation Landscape

2.1 Under-resourced but highly dynamic

Although Africa contributes only a small share of global health R&D spending, innovation activity has accelerated in the past decade. Analyses by the World Economic Forum and regional science councils note that African countries, on average, devote less than 0.5% of GDP to R&D, with only a handful (e.g., South Africa, Kenya, Morocco, Tunisia) approaching or surpassing 1%. World Economic Forum+1 Limited domestic investment means African innovators often depend on external donors and philanthropic programs, which can skew priorities and create unstable funding cycles.

Even within these constraints, the continent has seen:

-

A growing number of healthtech start-ups and digital health pilots; healthtechafrica.org

-

The emergence of local manufacturing and R&D capabilities, catalyzed by COVID-19 supply disruptions; PATH

-

Increasingly sophisticated clinical research networks, especially in countries like South Africa, Kenya, and Senegal. World Health Organization

2.2 Systemic vulnerabilities exposed by COVID-19

The COVID-19 pandemic highlighted Africa’s dependence on imported vaccines, diagnostics, and therapeutics, as well as weak clinical trial infrastructure and fragmented regulatory systems. A recent analysis emphasizes gaps across the health R&D landscape: limited local manufacturing, inadequate clinical research capacity, and under-resourced regulatory agencies. PATH+1 This combination makes it difficult to move from successful pilots to continent-wide deployment.

3. The Research-to-Market Gap

The translational gap in African health innovation can be understood across several interlinked domains.

3.1 Financing and the “valley of death”

Early-stage research funding is often grant-driven, while late-stage expansion may attract impact investors or development finance. The most acute shortfall is in mid-stage financing—for prototyping, regulatory studies, pilots, and initial commercialization—where risks are high but returns uncertain. Studies of African research funding point to declining private-sector R&D participation and continued reliance on external donors. SGCI Africa+1

3.2 Fragmented and slow regulation

Historically, each African country has maintained its own medicines regulatory authority with varying capacity, leading to long, duplicative approval processes for drugs, diagnostics, and devices. This fragmentation raises costs and delays regional scale-up. Catalyst Global+1

In response, the African Medicines Regulatory Harmonization (AMRH) initiative and the newly established African Medicines Agency (AMA) aim to streamline and harmonize regulatory processes across the continent, strengthening oversight and reducing time-to-market for priority health products. AMRH+2Wikipedia+2 As of late 2024, most African Union member states had either signed or ratified the AMA treaty, but full operationalization and resourcing remain ongoing challenges. Wikipedia+1

3.3 Limited manufacturing and supply-chain capacity

Only a small fraction of medicines and medical products used in Africa are manufactured locally. Estimates suggest that African manufacturers produce roughly 10–30% of pharmaceuticals consumed on the continent, with strong geographic concentration. Wikipedia+1 When promising innovations emerge—such as new diagnostics or biologics—local capacity to produce at scale is often missing, forcing innovators to rely on external manufacturers and complex import pathways.

3.4 Weak technology transfer and commercialization support

Many universities and public research institutes lack robust technology transfer offices (TTOs), clear intellectual property policies, or experienced commercialization teams. Recent initiatives, such as webinars and capacity building under the African Centre for Technology Studies (ACTS) and similar organizations, underscore persistent gaps in turning patents and prototypes into investable ventures. Acts Network+1

3.5 Health system and market constraints

Finally, even when a solution is technically sound and approved, adoption can stall due to:

-

Underfunded public health budgets; AP News+1

-

Human resource shortages and training needs;

-

Inadequate digital and physical infrastructure;

-

Procurement processes that favor established multinational suppliers over local innovators. PATH+1

Taken together, these factors explain why so many promising African health innovations remain pilots rather than scaled, sustainable services.

4. Case Studies of Health Innovation and Translation

4.1 Zipline’s medical drone delivery in Rwanda, Ghana, and Côte d’Ivoire

Innovation and impact. Since 2016, Rwanda has partnered with Zipline, a drone logistics company, to deliver blood and other essential medical supplies to remote facilities. Evaluations show that drone delivery substantially reduces delivery times—from hours to minutes—and mitigates stock-outs and wastage of temperature-sensitive products. healthtechafrica.org+2The Reach Alliance+2 In Ghana, impact studies similarly report reduced lead times and improved availability of key commodities at last-mile public health facilities. Zipline+1 Côte d’Ivoire has followed suit, using drones to serve hundreds of health centers in hard-to-reach areas. Le Monde.fr

Translational lessons.

-

Enablers: Strong political leadership, long-term national contracts, and donor interest helped Zipline move rapidly from pilot to national scale, effectively bypassing some traditional commercialization hurdles. healthtechafrica.org+1

-

Remaining gaps: Sustainability debates persist around cost per delivery and long-term financing models, especially where services are subsidized. Integration into national blood and vaccine supply-chain information systems also requires ongoing investment and regulatory clarity for beyond-visual-line-of-sight operations. UPDWG+1

Overall, Zipline demonstrates that sophisticated, high-tech solutions can scale in African health systems—when regulatory permissions, public procurement, and blended financing line up.

4.2 MomConnect: Digital maternal health in South Africa

Innovation and implementation. MomConnect is a flagship program of South Africa’s National Department of Health that sends free SMS or WhatsApp messages to pregnant women and new mothers, along with a helpdesk for queries and feedback. Health.gov.za Impact evaluations in Johannesburg and other regions indicate that bi-weekly pregnancy-tailored messages are a feasible, relatively low-cost way to increase antenatal care attendance and facility-based deliveries. measureevaluation.org+1

A broader review of mobile health interventions for maternal and child health in South Africa identifies MomConnect among several digital tools (including NurseConnect and ChildConnect) that have improved access to information and services. ScienceDirect

Translational lessons.

-

Enablers:

-

Clear ownership by the Ministry of Health;

-

National-level scale-up strategy;

-

Use of simple, accessible technologies (SMS, basic phones). Health.gov.za+1

-

-

Challenges:

-

Digital divide (network coverage, literacy, handset access);

-

Integration of MomConnect data into routine health information systems;

-

Ongoing funding for platform maintenance and message costs. ScienceDirect+1

-

MomConnect illustrates how public-sector leadership can convert a digital health pilot into a national program—while highlighting the need for robust digital infrastructure and recurrent budget lines to keep such innovations viable.

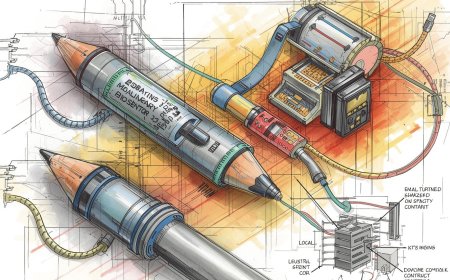

4.3 mPedigree: Anti-counterfeit verification for medicines and seeds

Innovation and evolution. Ghana-based mPedigree developed a mobile verification system allowing consumers to check whether medicines are genuine by scratching a label and texting a code to a short number. The system, later extended to agro-inputs such as seeds, has been endorsed by regulatory authorities and adopted by multiple manufacturers. Afri54blog+3Stanford Social Innovation Review+3Wikipedia+3

Translational lessons.

-

Enablers:

-

A simple consumer-facing verification method built on existing mobile networks;

-

Partnerships with pharmaceutical companies, regulators, and agribusiness firms;

-

Positioning as a supply-chain transparency tool aligned with public-health and food-security priorities. Stanford Social Innovation Review+2AECF+2

-

-

Challenges:

-

Dependence on manufacturers’ willingness to pay for serialization and verification services;

-

Need to adapt to evolving regulatory requirements and counterfeiters’ tactics;

-

Difficulty in rapidly expanding across jurisdictions with differing regulations and telecom environments. Wikipedia+1

-

mPedigree highlights how African innovators can create globally relevant solutions, but also how multi-country regulatory and market fragmentation slows scaling.

4.4 Local diagnostics: Moldiag’s mpox test in Morocco

In response to mpox outbreaks, Moroccan startup Moldiag became the first African company to produce mpox diagnostic tests, priced around US$5 per test and marketed across several African countries. AP News This initiative responds directly to the continent’s longstanding reliance on imported diagnostics and the scarcity of testing capacity in many regions.

Yet, Moldiag’s trajectory also reveals key constraints:

-

Limited laboratory infrastructure in some target countries reduces market uptake;

-

Procurement and reimbursement systems may favor established international suppliers;

-

Regulatory approvals and quality assurance must be navigated across multiple jurisdictions. PATH+1

This case shows both the feasibility and the fragility of building local manufacturing capacity for diagnostics in Africa.

4.5 Genomics-driven cancer innovation: Yemaachi Biotech

Ghana-based Yemaachi Biotech is building a large African cancer genomics database—the African Cancer Atlas—to underpin more effective diagnostics and therapeutic discovery tailored to African populations. The Guardian The project aims to recruit thousands of patients and make resulting data accessible to African researchers, with backing from industry partners such as Roche.

Translational lessons.

-

The initiative exemplifies frontier science coming from Africa, addressing global data gaps in oncology research. The Guardian+1

-

However, it also depends on complex ethical frameworks, sustainable financing, and eventual pathways to commercial products (e.g., companion diagnostics, targeted drugs) that benefit African patients rather than exporting value abroad. The Guardian+1

Yemaachi underscores emerging tensions around data ownership, benefit sharing, and equitable commercialization in high-tech African health innovation.

5. Cross-Cutting Insights from Case Studies

Across these diverse examples, several common themes emerge:

-

Policy and political leadership matter. Zipline and MomConnect scaled where governments made explicit commitments, integrated innovations into national strategies, and allocated budgets or signed long-term contracts. healthtechafrica.org+2Health.gov.za+2

-

Regulatory harmonization is necessary but not sufficient. Initiatives such as AMRH and AMA can reduce duplicative work and accelerate cross-border access, but their benefits depend on timely implementation, sustained staffing, and alignment with regional economic communities. AMRH+2Wikipedia+2

-

Local manufacturing and supply chains are the weak link. Whether for drones (spare parts and maintenance), diagnostics (Moldiag), or pharmaceuticals (mPedigree), limited local production and logistics capacity often force innovators into expensive, fragile arrangements. PATH+2Path+2

-

Translational funding is patchy. Donors and challenge funds (e.g., Grand Challenges Africa) play a crucial role in early-stage support, but late-stage financing for regulatory studies, manufacturing, and market expansion remains scarce. SGCI Africa+3scienceforafrica.foundation+3AA Sciences+3

-

Health-system absorption is a major bottleneck. Innovations demand human resources, training, infrastructure, and procurement reforms. Without these, even well-validated interventions remain compartmentalized pilots. ScienceDirect+2PATH+2

6. Emerging Ecosystem Responses

6.1 Grand Challenges Africa and related funding models

Grand Challenges Africa, hosted by the Science for Africa Foundation, provides competitive grants to African innovators to develop solutions for health and development challenges, with a strong emphasis on translation and impact. scienceforafrica.foundation+2AA Sciences+2 The program supports not just discovery but also capacity building, collaboration networks, and, increasingly, pathways to commercialization.

Similarly, development partners such as Grand Challenges Canada report using blended finance and partnership models (e.g., the m-mama emergency transport project) to de-risk innovation and crowd in private investment. Grand Challenges Canada

6.2 Regulatory and manufacturing initiatives

The AMRH initiative and the upcoming AMA are designed to:

-

Provide centralized scientific assessments of priority medical products;

-

Harmonize regulatory requirements;

-

Support local manufacturing via clearer, more predictable approval pathways. NEPAD+3AMRH+3European Medicines Agency (EMA)+3

At the same time, the Pharmaceutical Manufacturing Plan for Africa (PMPA) emphasizes reducing reliance on imports and combating substandard products, further incentivizing regional production. Path+1

These developments, while still maturing, are foundational for a more integrated health innovation market in Africa.

7. Recommendations for Bridging the Gap

Based on the literature and case studies, several strategies emerge for narrowing the research-to-market divide:

-

Increase and refocus domestic R&D investment.

-

Move toward at least 1% of GDP spending on R&D, with dedicated envelopes for health innovation. World Economic Forum+1

-

Encourage business-sector participation through tax incentives, co-investment schemes, and procurement preferences for locally developed solutions. SGCI Africa+1

-

-

Create translational and acceleration funds.

-

Establish national or regional funds specifically targeting the “valley of death”: prototype refinement, clinical validation, regulatory dossiers, and early commercialization.

-

Use blended finance (public, philanthropic, impact investors) to de-risk investments in health innovations with strong public-health value. scienceforafrica.foundation+2Grand Challenges Canada+2

-

-

Strengthen technology transfer and commercialization capacity.

-

Professionalize TTOs within universities and research institutes, with clear IP policies and performance incentives tied to licensing and spin-offs. Acts Network+1

-

Train scientists and clinicians in entrepreneurship, business planning, and regulatory science.

-

-

Fully operationalize AMA and deepen regional harmonization.

-

Prioritize resourcing of AMA and AMRH technical committees to deliver predictable, transparent, and rapid review processes for priority health technologies. Wikipedia+2European Medicines Agency (EMA)+2

-

Align regional economic communities’ regulatory initiatives with AMA to avoid parallel systems.

-

-

Invest in local manufacturing and resilient supply chains.

-

Support public–private partnerships for vaccine, diagnostic, and medical device manufacturing, building on lessons from COVID-19, Moldiag, and others. PATH+2AP News+2

-

Facilitate access to quality raw materials, technology transfer, and good manufacturing practice (GMP) training.

-

-

Reform procurement to favor innovation and local solutions.

-

Introduce “innovation-friendly” procurement tools, such as outcome-based contracts, advance market commitments, and preferential scoring for local or regional innovators meeting quality standards. PATH+1

-

-

Center equity, ethics, and benefit-sharing.

-

Ensure that initiatives like Yemaachi’s cancer atlas adopt robust governance for data use, community consent, and fair distribution of commercial benefits. The Guardian+1

-

Protect against extractive partnerships in advanced fields like genomics, AI, and digital health.

-

8. Conclusion

Africa’s health innovation story is not one of scarcity of ideas, but of bottlenecks in translation. Drone delivery networks, national mHealth platforms, anti-counterfeit verification systems, local diagnostic manufacturing, and cutting-edge cancer genomics projects all demonstrate the continent’s capacity to generate and deploy world-class solutions. Yet these cases also reveal systemic weaknesses in financing, regulation, manufacturing, and health-system absorption that prevent many innovations from moving beyond the pilot stage.

Bridging the gap between research and market-ready solutions will require coordinated action: more ambitious domestic R&D spending, purpose-built translational finance, robust technology transfer capacity, operationalized continental regulation through AMA, strategic industrial policy for health manufacturing, and procurement reforms that reward innovation. If these elements can be aligned, Africa is well-positioned not only to meet its own pressing health needs, but also to contribute globally relevant medical innovations grounded in the realities of low- and middle-income settings.

References

-

African Centre for Technology Studies. (2024). Bridging innovation and market: Effective technology transfer and commercialization.

-

Grand Challenges Africa / Science for Africa Foundation. (2024). Grand Challenges Africa: Fostering innovation for health and development.

-

Le Monde. (2025, June 19). La Côte d’Ivoire développe la livraison de produits de santé par drones.

-

Moldiag. (2024). Mpox diagnostic manufacturing in Africa [News report summary].

-

PATH. (2023). Strengthening Africa’s health R&D and manufacturing ecosystem: Analysis of the investments and gaps.

-

Science for Africa Foundation. (2024). Grand Challenges Africa.

-

Simons, B. (2025). Bright Simons and the fight against counterfeit drugs with mPedigree.

-

South African National Department of Health. (n.d.). MomConnect.

-

UNESCO Institute for Statistics & World Bank. (2025). Research & development spending as a share of GDP [Dataset].

-

World Economic Forum. (2023). Innovative approaches for unlocking R&D funding in Africa.

-

Yemaachi Biotech. (2025). African Cancer Atlas initiative.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0